What is a Dividend Auto-Invest Plan?

Dividend Auto-Invest Plan ("DAIP") is a client's instruction ("plan") to automatically use the cash dividends they received to purchase the same securities they hold. Please note that automated purchases with cash dividends received from corporate actions that offer optional dividends cannot be facilitated with your DAIP.

Where do I go to set up my DAIP?

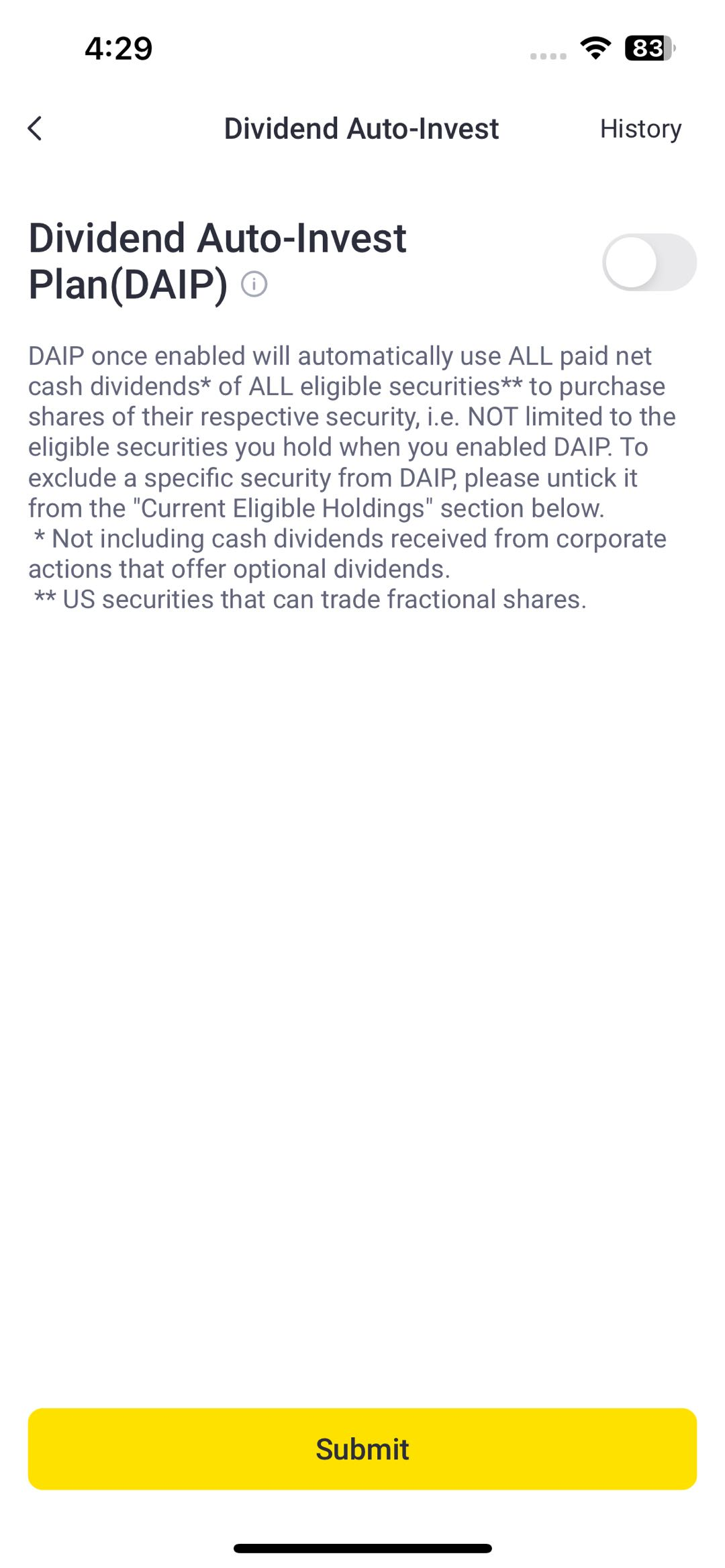

You can enter the DAIP page through the Tiger Trade App's "Portfolio" - "More Functions" - "Dividend Auto-Invest Plan" to enable and configure your DAIP. Toggle the DAIP switch on, untick a security from the "Current Eligible Holdings" section to exclude it from your DAIP (if applicable), and click the Submit button and then the Save button to effect your settings.

What types of securities can be included in my DAIP?

DAIP is only available for securities you hold that meet ALL the following conditions ("eligible securities"):

Cash dividends received from corporate actions that offer optional dividends will not be included in DAIPs;

Restricted to US listed stocks and ETFs that distribute cash dividends only;

Restricted to US listed stocks and ETFs that are available for fractional shares trading.

Can I set up my DAIP before I hold any eligible securities?

Yes! In fact, once you have enabled the DAIP facility, ALL future net cash dividend proceeds of eligible securities that you then hold will trigger their respective DAIP purchase, i.e. NOT limited to the eligible securities you hold when you enabled your DAIP. To exclude all future cash dividends of certain eligible securities you hold from being earmarked for DAIP automated purchases, you will need to exclude (untick) the securities from the "Current Eligible Holdings" section of the DAIP page.

What is the "cut-off point" to enable/ exclude a certain security from my DAIP ?

You need to have enabled/ excluded that certain security from your DAIP no later than one trading day before its cash dividend's payment date (US Eastern Time).

When will a DAIP order be placed?

DAIP order will be placed one trading day after the cash dividend's payment date, during the regular trading hours (US Eastern Time).

Will the full amount of the distributed dividend be used for a DAIP automated purchase?

Distributed dividends will be subject to tax whether you use such dividends to purchase the same security or not. So, the after-tax amount less trading-related fees is the maximum amount available for DAIP automated purchase, subject to the minimum quantity or amount of fractional shares trading.

What are the fees associated with a trade executed via DAIP?

Standard trading fees (not the promotional fees) will apply to automate a purchase with DAIP, just like the Auto-Invest Plans. Details can be found in the 'Help Center'.

Will my DAIP order be placed when there is an outstanding loan in my Tiger account?

Yes.

If you wish to repay your loan with the cash dividend received rather than using it to purchase more shares through DAIP, please exclude that security from your DAIP before its cut-off point (one trading day before the dividend's payment date (US Eastern Time)). Please note that loans are currency-specific and segment-specific (securities segment vs futures segment).

What would hinder the processing of a DAIP order?

When your account is not restricted from trading, either one of the following reasons can hinder the processing of your DAIP order apart from external factors such as suspension of trading or lack of liquidity:

the security that you once removed from your DAIP was subsequently added back to your DAIP on or after its cut-off point (one trading day before the dividend's payment date (US Eastern Time)),

the net cash dividend received is insufficient to cover the minimum quantity or amount of fractional shares trading and its trading-related fees,

you no longer hold the security when we are processing your DAIP order,

the net cash dividend received was removed before we can process your DAIP order, or

the processing of the DAIP order will trigger a margin call or is prohibited by an existing margin call for your Tiger account's securities segment.

Recently processed and failed DAIP orders can be accessed via the "History" link on the DAIP page.