U.S. stock futures rose on Wednesday after Tuesday’s advances. Futures of major benchmark indices were higher.

The three-day winning streak comes amid a holiday-shortened week, as the markets will be closed on Thursday and open till 1:00 p.m. ET on Friday.

Traders are aggressively pricing in a December cut amid dovish central bank guidance.

Meanwhile, the 10-year Treasury bond yielded 4.01% and the two-year bond was at 3.46%. The CME Group's FedWatch tool‘s projections show markets pricing an 84.9% likelihood of the Federal Reserve cutting the current interest rates during its December meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.21% |

| S&P 500 | 0.23% |

| Nasdaq 100 | 0.29% |

| Russell 2000 | 0.22% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Wednesday. The SPY was up 0.29% at $677.01, while the QQQ advanced 0.36% to $611.10, according to Benzinga Pro data.

Stocks In Focus

Dell Technologies

- Dell Technologies Inc. (NYSE:DELL) jumped 4.94% after reporting mixed financial results for the third quarter on Tuesday. It raised its full-year outlook, expecting fiscal 2026 revenue in the range of $111.2 billion to $112.2 billion, up from a prior range of $105 billion to $109 billion.

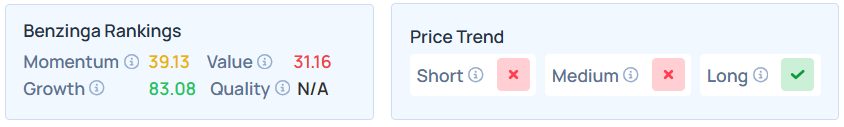

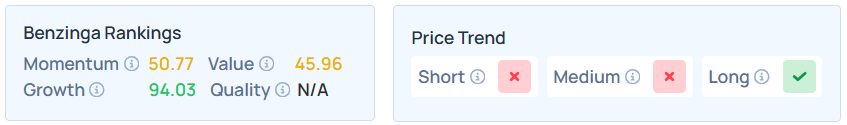

- Benzinga’s Edge Stock Rankings indicate that DELL maintains a weaker price trend over the short and medium terms but a strong trend in the long term, with a solid growth ranking. Additional performance details are available here.

HP

- HP Inc. (NYSE:HPQ) tumbled 5.67% despite posting better-than-expected earnings for its fourth quarter after Tuesday's closing bell. However, the company announced layoffs and issued weak forward guidance.

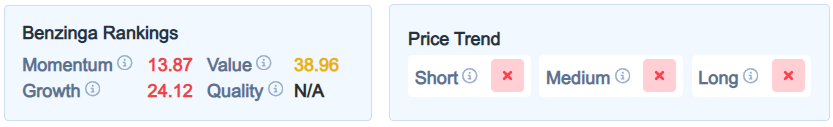

- HPQ maintained a weaker price trend over the short, long, and medium terms, with a moderate value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Autodesk

- Autodesk Inc. (NASDAQ:ADSK) climbed by 7% following third-quarter earnings and revenue beat. It also guided for full-year revenue of $7.15 billion to $7.17 billion and raised its full-year adjusted earnings guidance to a new range of $10.18 to $10.25 per share, versus estimates of $9.95 per share.

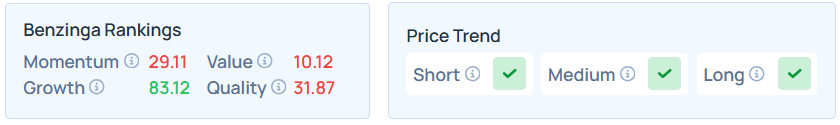

- Benzinga’s Edge Stock Rankings shows that ADSK maintains a stronger price trend over the short, medium, and long terms, with a poor quality ranking. Additional information is available here.

Zscaler

- Zscaler Inc. (NASDAQ:ZS) dropped 7.15% despite beating analyst estimates on the top and bottom lines and raising its fiscal 2026 adjusted EPS and revenue outlook.

- It maintained a weaker price trend over the short and medium terms but a strong trend in the long term, with a strong growth ranking. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here.

Uber Technologies

- Uber Technologies Inc. (NYSE:UBER) was up 0.73% after it announced the launch of Level 4 fully driverless Robotaxi commercial operations in Abu Dhabi, along with WeRide Inc. (NASDAQ:WRD), which gained 1.52%.

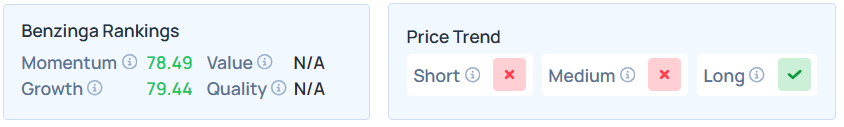

- UBER maintained a weaker price trend over the short and medium term but a strong trend in the long term, with a moderate value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Communication services, health care, and consumer discretionary stocks recorded the biggest gains on Tuesday, leading most S&P 500 sectors into positive territory.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 0.67% | 23,025.59 |

| S&P 500 | 0.91% | 6,765.88 |

| Dow Jones | 1.43% | 47,112.45 |

| Russell 2000 | 2.14% | 2,465.98 |

Insights From Analysts

Jeremy Siegel, the celebrated Wharton professor and author of Stocks for the Long Run, delivered a pointed critique of President Trump's trade strategies during a recent appearance on the Icons and Ideas podcast. Siegel argued that requiring businesses to petition the White House for tariff relief undermines free-market principles.

“I don’t particularly like [that] you have to go to the court of Donald Trump to get [exemptions]… that’s not good capitalism,” Siegel said. “That’s not good free markets as far as I’m concerned.”

While Siegel classifies the tariffs as “net a negative” for the U.S. economy, he remains optimistic about the broader market. He explained that these protectionist downsides are outweighed by pro-business moves, such as deregulation and a retreat from the Biden administration’s “crazy antitrust” stance.

Ultimately, Siegel believes the administration’s broader agenda creates a favorable environment for investors. “The deregulation… the less fervent anti-merger movement… that offsets, more than offsets, the negative of the tariffs,” he concluded.

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on Wednesday;

- Initial jobless claims data for the week ending Nov. 22 and September’s delayed durable-goods orders data will be announced by 8:30 a.m. ET.

- No data is scheduled to be released for the Thanksgiving holiday on Thursday.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 0.22% to hover around $57.98 per barrel.

Gold Spot US Dollar rose 0.78% to hover around $4,163.00 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was 0.11% higher at the 99.7780 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.07% higher at $86,938.43 per coin.

Asian markets closed higher on Wednesday as India’s NIFTY 50, Hong Kong's Hang Seng, Australia's ASX 200, China’s CSI 300, Japan's Nikkei 225, and South Korea's Kospi indices rose. European markets were mostly higher in early trade.

Read Next:

- Google TPUs Are ‘Cost-Effective Hedge,’ Not Replacement For Nvidia, Strategist Says

Photo courtesy: Shutterstock