Lucid Group Inc (NASDAQ:LCID) shares continued their slide Friday afternoon, following the company’s third-quarter 2025 results released Wednesday, which missed analyst expectations. Here’s what investors need to know.

- LCID is taking a hit from negative sentiment. Get the complete picture here.

What To Know: The EV maker reported a third-quarter adjusted loss of $2.65 per share, significantly wider than the consensus estimate of a $2.27 per share loss. Revenue for the quarter was $336.6 million, also falling short of forecasts.

Lucid announced it produced 3,891 vehicles and delivered 4,078 vehicles in the third quarter.

Alongside the earnings miss, Lucid announced a major organizational shakeup to “accelerate growth.” Key changes include the appointment of Emad Diala as senior vice president of Engineering and Erwin Raphael as senior vice president of Revenue. Notably, Eric Bach, senior vice president of Product and Chief Engineer, has departed the company.

While Lucid highlighted a strong liquidity position of $5.5 billion, bolstered by an increased term loan facility, the earnings miss and executive reorganization appear to be weighing on investor sentiment. The company also announced a new collaboration with Nvidia for Level 4 autonomous driving but provided no update to its 2025 production forecast.

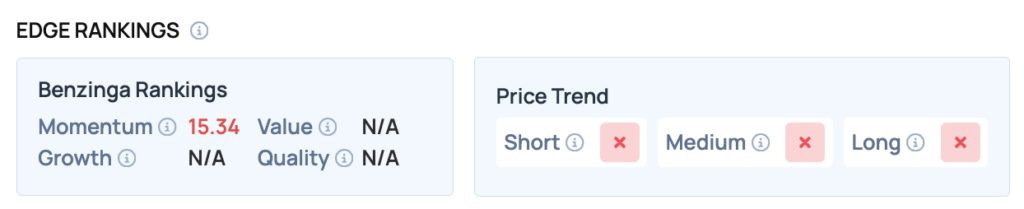

Benzinga Edge Rankings: Benzinga’s Edge Rankings reflect Friday’s price pressure, showing a negative price trend for the stock across short-, medium- and long-term outlooks.

LCID Price Action: Lucid Group shares closed Friday down 3.79% at $17.28, according to Benzinga Pro data.

Read Also: Rivian Loses Steam on Mixed Signals; Trades Below Tesla

How To Buy LCID Stock

Besides going to a brokerage platform to purchase a share — or fractional share — of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For the Lucid Group, it is in the Consumer Discretionary sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Courtesy Lucid