Robinhood (NASDAQ:HOOD) CEO Vlad Tenev said on Wednesday that the company is still evaluating whether to include Bitcoin (CRYPTO: BTC) in its corporate treasury, weighing the potential pros and cons.

Need To Align With Shareholders, Says CEO

During the company’s third-quarter earnings call, Tenev said that Robinhood has devoted considerable time to pondering this move. He highlighted that such a step would require alignment from the community.

“If you put it [Bitcoin] on your balance sheet, it has the positives in that you're aligned with the community, but it does take up capital,” Tenev said, adding that such a decision could have both “pros and cons.”

He highlighted that Robinhood’s shareholders can already buy Bitcoin directly on the platform.

“Are we making that decision for them? Is it the best use of our capital?” Tenev said. “I think the short answer is we're still thinking about it.”

See Also: Kevin O’Leary Says AI No Longer ‘Hype,’ But Real Driver Of Productivity As Bitcoin Miners Accelerate Shift Into AI Infrastructure Business

Will Robinhood Follow In Strategy’s Footsteps?

Tenev said previously that holding Bitcoin for investment purposes could possibly "complicate" things for public investors. He emphasized that the Robinhood stock is already highly correlated to Bitcoin even without the firm holding the asset on its books.

Strategy Inc. (NASDAQ:MSTR) remains the pioneer and the world’s biggest corporate holder of Bitcoin, with more than $73 billion in BTC in its reserves.

Robinhood Reports Strong Q3 Results

Tenev’s remarks follow the commission-free trading platform’s third-quarter financial results, which showed a double beat and record revenue. The trading platform has seen significant growth, with its stock up 280% year-to-date, and has been referred to as “one of the hottest stocks of 2025.”

Robinhood’s cryptocurrency-based transaction revenue soared 300% year-over-year.

Price Action: Shares of Robinhood dipped 2.03% in after-hours trading after closing 4.15% higher at $142.48 during Wednesday’s regular trading session, according to data from Benzinga Pro. Year-to-date, the stock has lifted over 280%.

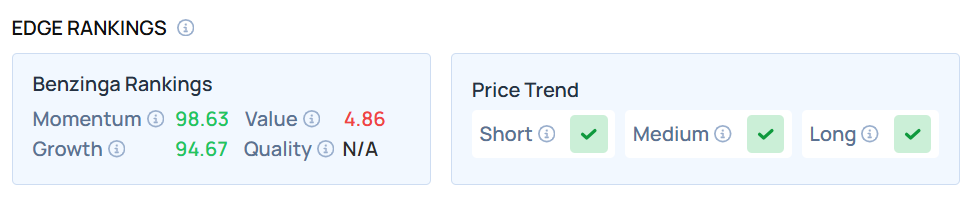

HOOD exhibited very high Momentum and Growth scores as of this writing. Do you want to know how it compares to the highest-weighted stock in your portfolio? Go to Benzinga Edge Stock Rankings and find out.

Read Next:

- Robinhood, Duolingo, Qualcomm, Applovin And Snap: Why These 5 Stocks Are On Investors’ Radars Today

Photo: NRSPro / Shutterstock.