nVent Electric plc (NYSE:NVT) reported its third-quarter results on Friday that topped street estimates.

The company reported adjusted earnings of 91 cents per share, up 44% from the prior year period, surpassing analysts' expectations of 88 cents.

Net sales climbed to $1.05 billion, up 35% from a year earlier and ahead of estimates of $1.01 billion, while organic sales growth was 16% for the quarter. The company's adjusted operating income rose 27% to $213 million.

nVent Electric raised its full-year 2025 outlook, now expecting reported sales growth of 27% to 28%, up from its prior guidance of 24% to 26%.

The company also projects adjusted earnings per share of $3.31 to $3.33, compared with the earlier range of $3.22 to $3.30. Wall Street analysts anticipate earnings of $3.29 per share from sales of $3.76 billion.

For the fourth quarter, nVent anticipates reported sales growth of 31% to 33% and organic sales growth of 15% to 17%, with an adjusted EPS forecast of between 87 cents and 89 cents. In contrast, Wall Street analysts expect an adjusted EPS of 88 cents.

nVent Electric shares fell 1% to trade at $113.22 on Monday.

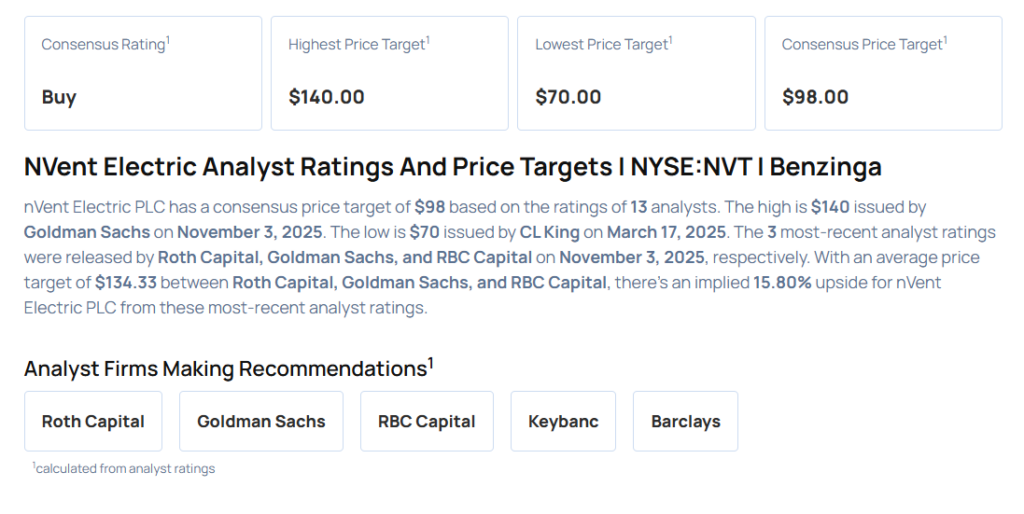

These analysts made changes to their price targets on nVent Electric following earnings announcement.

- RBC Capital analyst Deane Dray maintained nVent Electric with an Outperform rating and raised the price target from $117 to $133.

- Goldman Sachs analyst Joe Ritchie maintained the stock with a Buy and raised the price target from $111 to $140.

- Roth Capital analyst Justin Clare reiterated nVent Electric with a Buy and raised the price target from $115 to $130.

Considering buying NVT stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From Pfizer Stock Ahead Of Q3 Earnings

Photo via Shutterstock