Aon plc (NYSE:AON) reported better-than-expected earnings for the third quarter on Friday.

The company posted quarterly earnings of $3.05 per share which beat the analyst consensus estimate of $2.91 per share. The company reported quarterly sales of $3.997 billion which beat the analyst consensus estimate of $3.956 billion.

“Our Aon United strategy, accelerated through our 3×3 Plan, is delivering strong results. We are attracting top talent in high-growth areas, scaling our data analytics across our core Risk Capital and Human Capital businesses, expanding in the middle market and unlocking new sources of capital,” said Greg Case, president and CEO. “We are executing with discipline and increasing the value we deliver to our clients – winning in existing markets, creating demand in emerging areas and innovating unique capital solutions.”

Aon shares fell 0.4% to trade at $338.64 on Monday.

These analysts made changes to their price targets on Aon following earnings announcement.

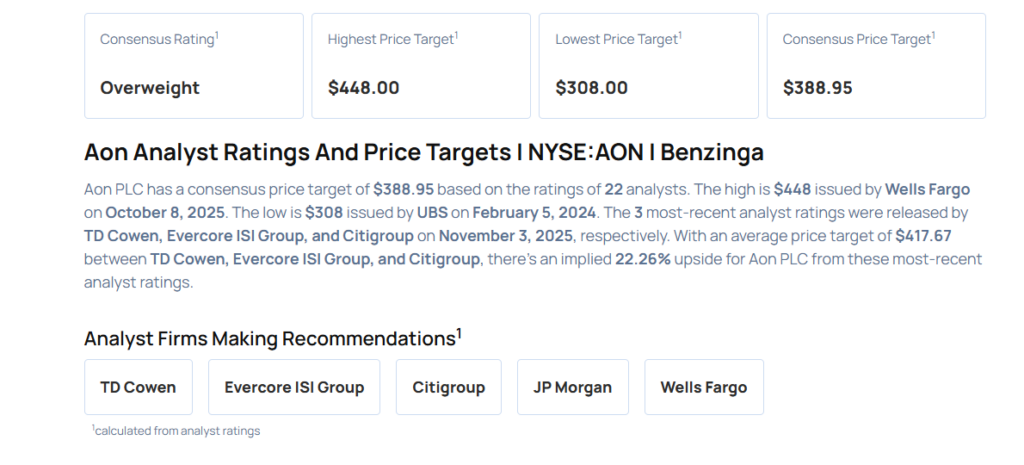

- Citigroup analyst Matthew Heimermann upgraded Aon from Neutral to Buy and maintained the price target from $402 to $402.

- Evercore ISI Group analyst David Motemaden maintained Aon with an Outperform rating and raised the price target from $427 to $435.

- TD Cowen analyst Andrew Kligerman maintained the stock with a Buy and lowered the price target from $419 to $416.

Considering buying AON stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From Pfizer Stock Ahead Of Q3 Earnings

Photo via Shutterstock