Vertiv Holdings Co (NYSE:VRT) reported better-than-expected third-quarter fiscal 2025 results on Wednesday.

Net sales rose 29% year-over-year (Y/Y) to $2.68 billion, beating the consensus of $2.56 billion. Adjusted EPS stood at $1.24, beating the consensus of $0.99.

For fiscal 2025, Vertiv Holdings lifted its adjusted EPS guidance to $4.07–$4.13, up from $3.75–$3.85 and above the $3.81 consensus estimate. The company also raised its 2025 sales outlook to $10.16 billion–$10.24 billion, compared with the prior range of $9.93 billion–$10.08 billion and estimates of $10.04 billion.

For the fourth quarter, Vertiv expects adjusted EPS of $1.23–$1.29, versus the street view of $1.24, and revenue of $2.81–$2.89 billion, ahead of the $2.78 billion forecast.

Giordano Albertazzi, Vertiv's CEO, said, "We've accelerated a restructuring program in EMEA which reflects our proactive approach to optimize and focus operations and strengthens our ability to capitalize on improving EMEA market conditions that we expect to see in the second half of 2026."

Vertiv shares closed at $171.59 on Wednesday.

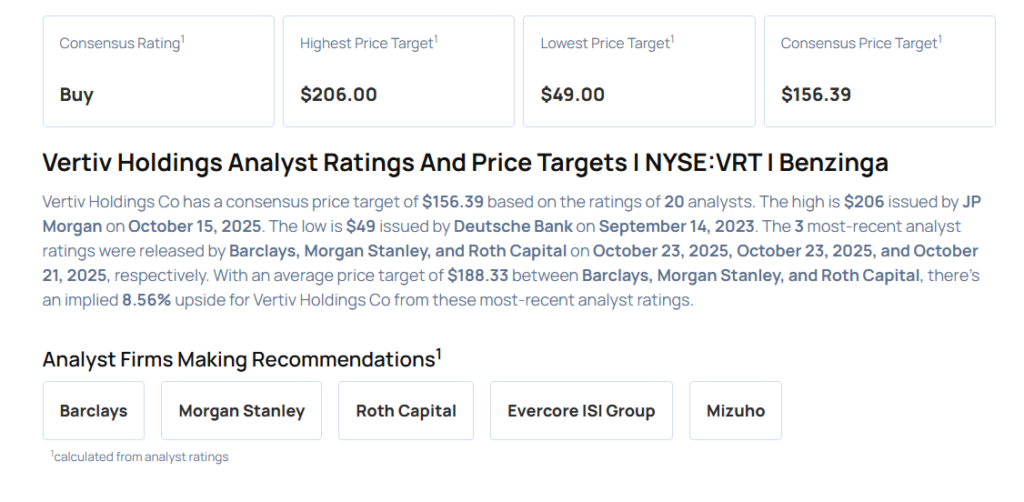

These analysts made changes to their price targets on Vertiv following earnings announcement.

- Morgan Stanley analyst Chris Snyder maintained Vertiv Holdings with an Overweight rating and raised the price target from $165 to $200.

- Barclays analyst Julian Mitchell maintained the stock with an Equal-Weight rating and raised the price target from $145 to $170.

Considering buying VRT stock? Here’s what analysts think:

Read This Next:

- Top 2 Materials Stocks That Are Ticking Portfolio Bombs

Photo via Shutterstock