Interactive Brokers Group, Inc. (NASDAQ:IBKR) will release earnings results for the third quarter, after the closing bell on Thursday, Oct. 16.

Analysts expect the Greenwich, Connecticut-based company to report quarterly earnings at 54 cents per share, up from 44 cents per share in the year-ago period. The consensus estimate for Interactive Brokers’ quarterly revenue is $1.52 billion, compared to $1.33 billion a year earlier, according to data from Benzinga Pro.

On Oct. 15, Interactive Brokers announced the launch of Ask IBKR, an AI-powered tool that delivers instant portfolio insights through natural language queries.

Interactive Brokers shares rose 0.6% to close at $69.77 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

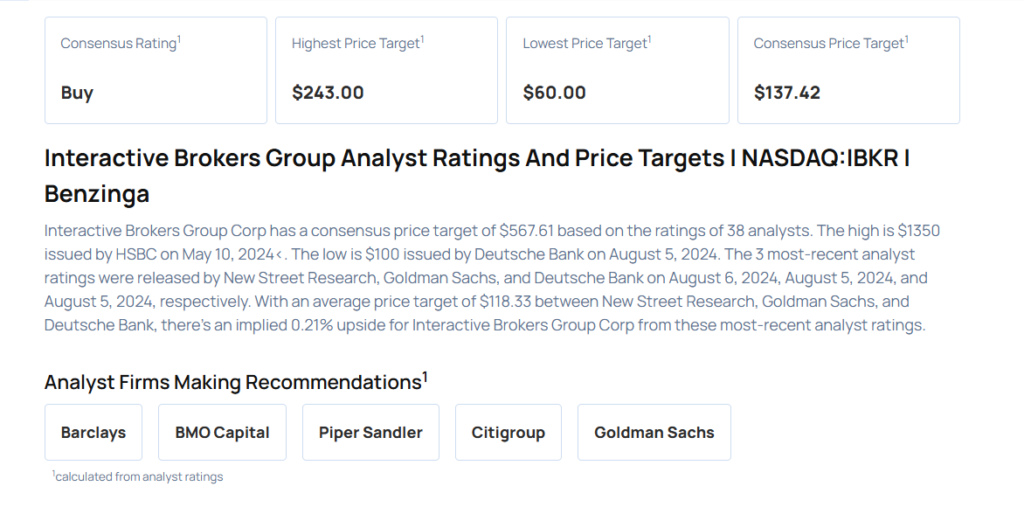

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Barclays analyst Benjamin Budish maintained an Overweight rating and raised the price target from $73 to $81 on Oct. 8, 2025. This analyst has an accuracy rate of 76%.

- BMO Capital analyst Brennan Hawken initiated coverage on the stock with an Outperform rating and a price target of $82 on Oct. 3, 2025. This analyst has an accuracy rate of 71%.

- Piper Sandler analyst Patrick Moley maintained an Overweight rating and raised the price target from $65 to $68 on July 18, 2025. This analyst has an accuracy rate of 87%.

- Citigroup analyst Christopher Allen maintained a Buy rating and increased the price target from $53.75 to $60 on July 7, 2025. This analyst has an accuracy rate of 70%.

- Goldman Sachs analyst James Yaro maintained a Buy rating and raised the price target from $212 to $240 on May 15, 2025. This analyst has an accuracy rate of 66%.

Considering buying IBKR stock? Here’s what analysts think:

Read This Next:

- Top 2 Financial Stocks That May Collapse This Quarter

Photo via Shutterstock