First Horizon Corp (NYSE:FHN) reported better-than-expected third-quarter EPS and sales results.

First Horizon reported quarterly earnings of 51 cents per share which beat the analyst consensus estimate of 44 cents per share. The company reported quarterly sales of $889.000 million which beat the analyst consensus estimate of $847.179 million.

“We are pleased to report another strong quarter, a testament to the disciplined execution of our strategy and the expertise of our associates,” said Chairman, President and CEO Bryan Jordan. “First Horizon’s diversified business model and attractive geographic footprint position us well amid a changing environment. Our ongoing focus on safety and soundness, profitability, and growth enables us to meet our clients’ evolving needs with tailored solutions that create meaningful value.”

First Horizon shares gained 0.4% to $20.92 on Thursday.

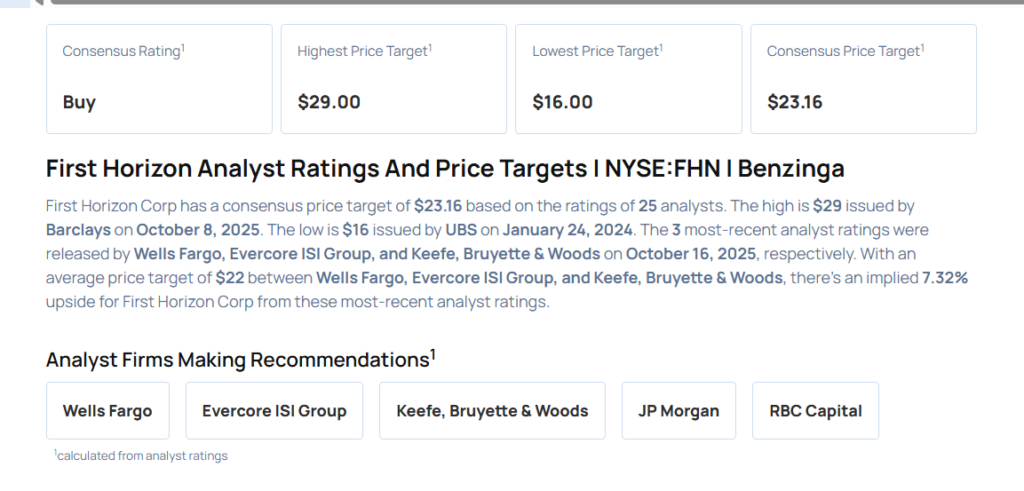

These analysts made changes to their price targets on First Horizon following earnings announcement.

- JP Morgan analyst Anthony Elian maintained First Horizon with a Neutral and lowered the price target from $25 to $23.

- Keefe, Bruyette & Woods analyst Brady Gailey maintained the stock with a Market Perform and lowered the price target from $24 to $23.

- Evercore ISI Group analyst John Pancari downgraded First Horizon from Outperform to In-Line and lowered the price target from $26 to $20.

- Wells Fargo analyst Timur Braziler maintained the stock with an Equal-Weight rating and lowered the price target from $25 to $23.

Considering buying FHN stock? Here’s what analysts think:

Read This Next:

- Top 2 Financial Stocks That May Collapse This Quarter

Photo via Shutterstock