Educational Development Corporation (NASDAQ:EDUC) jumped 46.42% to $2.00 during after-hours trading, following a 7.98% gain during Tuesday’s regular session, according to Benzinga Pro data.

Check out the current price of EDUC stock here.

Earnings Call Catalyst Drives Movement

The surge precedes the Oklahoma-based publisher’s fiscal 2026 second-quarter earnings call scheduled for October 9, at 4:30 PM ET. CEO Craig White and CFO Dan O’Keefe will share the results and answer questions.

See Also: SciSparc Stock Shoots Up Over 89% After Hours: What's Going On?

Business Operations

EDUC, known for educational program development, owns Kane Miller Books, Learning Wrap-Ups, and SmartLab Toys. It exclusively distributes Usborne books in the U.S. via multi-level marketing channels, reaching 4,000 retail outlets.

Technical Overview Shows Volatility

EDUC trades within a 52-week range of $0.92-$2.49 with an $11.77 million market capitalization. It has gained 23.05% over the past month.

The stock was at its highest point of 2.40 on September 25, 2024, but has dropped by 42.92% since then. From its lowest point of 1.05 on August 20, 2025, it has risen by 30.48%, now sitting at 1.37. Overall, the stock has lost 32.04% over the past year.

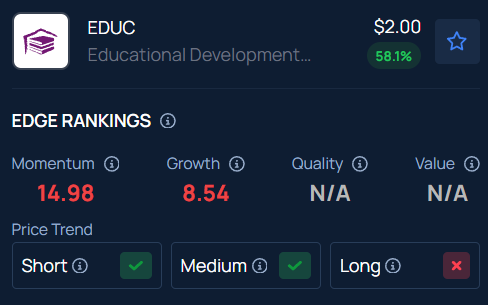

Benzinga’s Edge Stock Rankings indicate that EDUC is experiencing long-term consolidation along with medium and short-term upward movement. Know how its momentum lines up with other well-known names.

Read Next:

- US Semiconductor Sector Faces Anti-Dumping Investigation By China Ahead Of Trade Discussions

Image: Shutterstock/ Who is Danny:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.