Marvell Technology, Inc. (NASDAQ:MRVL) posted better-than-expected second-quarter earnings, but issued third-quarter sales guidance with a midpoint below estimates.

Marvell reported quarterly earnings of 67 cents per share, which beat the analyst estimate of 66 cents. Quarterly revenue came in at $2.006 billion which missed the Street estimate of $2.009 billion.

Marvell is looking for third-quarter adjusted earnings of between 69 cents and 79 cents per share, versus the 72-cent estimate, and revenue in a range of $1.957 billion to $2.163 billion, versus the $2.105 billion analyst estimate.

"Marvell delivered record revenue of $2.006 billion in the second quarter — a 58% year-over-year increase — and we expect continued growth into the third quarter, accompanied by operating margin and earnings per share expansion," said Matt Murphy, Marvell's CEO.

Marvell shares gained 3.3% to close at $77.23 on Thursday.

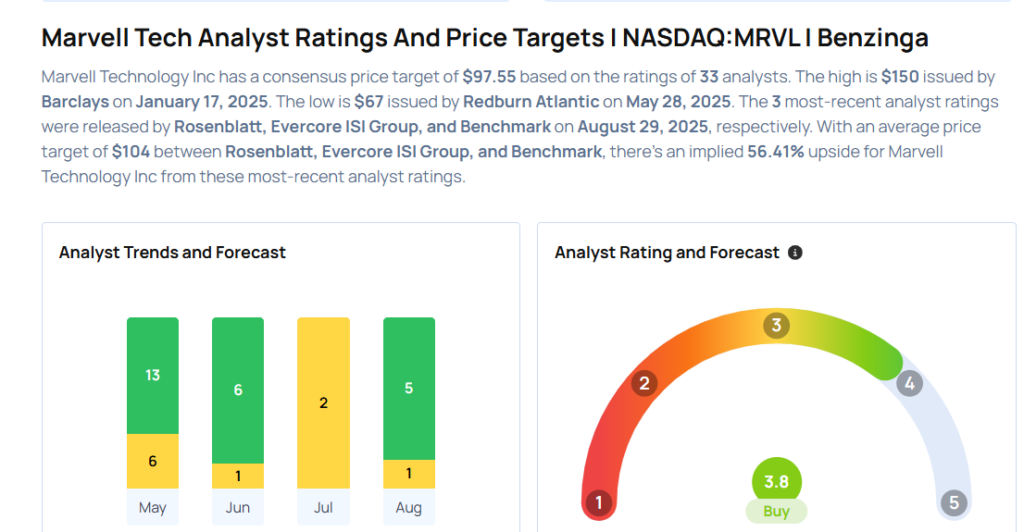

These analysts made changes to their price targets on Marvell following earnings announcement.

- Jefferies analyst Blayne Curtis maintained Marvell Tech with a Buy and lowered the price target from $90 to $80.

- B of A Securities analyst Vivek Arya downgraded the stock from Buy to Neutral and cut the price target from $90 to $78.

- Needham analyst N. Quinn Bolton maintained Marvell Tech with a Buy and lowered the price target from $85 to $80.

- Evercore ISI Group analyst Mark Lipacis maintained the stock with an Outperform rating and slashed the price target from $133 to $122.

- Rosenblatt analyst Kevin Cassidy maintained Marvell Tech with a Buy and lowered the price target from $124 to $95.

Considering buying MRVL stock? Here’s what analysts think:

Read This Next:

- Alibaba, Dell And 3 Stocks To Watch Heading Into Friday

Photo via Shutterstock