Alcon Inc (NYSE:ALC) posted better-than-expected earnings for the second quarter and cut its 2025 outlook late on Tuesday, citing increased tariff impact.

The company reported adjusted earnings of 76 cents per share, beating the consensus of 72 cents. Alcon reported second-quarter sales of $2.58 billion, up 4% year over year, missing the consensus of $2.63 billion.

"Alcon is exiting the second quarter with solid momentum, despite a relatively soft surgical market in the first half of the year," said David J. Endicott, Alcon's Chief Executive Officer. "Robust early demand for our recent product launches, including Unity VCS, Voyager, PanOptix Pro, Precision7, Systane Pro PF, and Tryptyr, has been encouraging. While it's still early, these launches position us to accelerate top-line growth, generate cash, and deliver long-term value for our shareholders."

Alcon affirmed fiscal year 2025 adjusted earnings of $3.05-$3.15 versus consensus of $3.12. The company lowered 2025 sales guidance from $10.4 billion-$10.5 billion to $10.3 billion-$10.4 billion, versus the consensus of $10.48 billion.

The company forecasts a full-year gross tariff impact of around $100 million from $80 million expected previously.

Alcon shares dipped 10.1% to close at $81.04 on Wednesday.

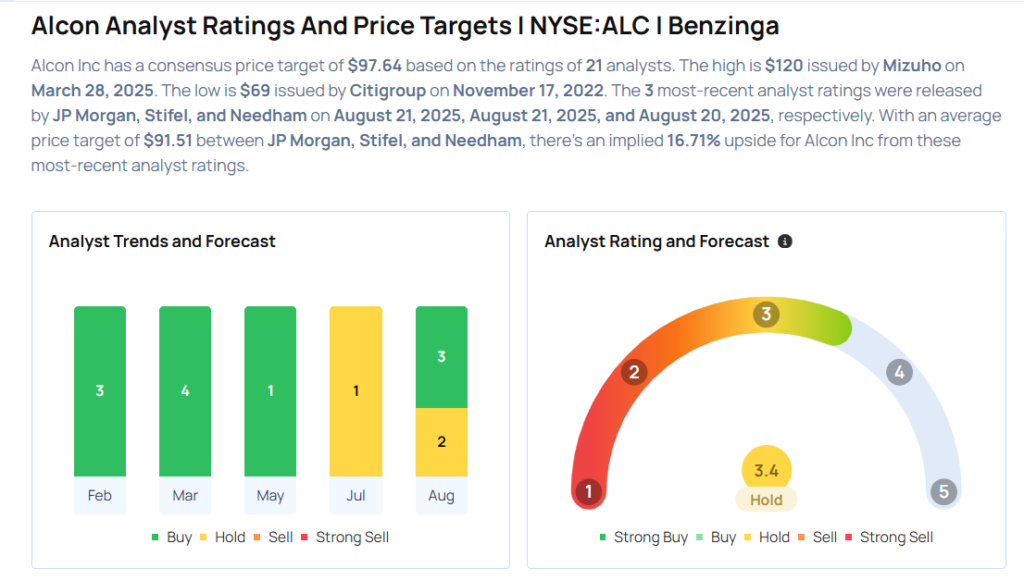

These analysts made changes to their price targets on Alcon following earnings announcement.

- Stifel analyst Tom Stephan maintained Alcon with a Buy and lowered the price target from $100 to $90.

- JP Morgan analyst David Adlington downgraded Alcon from Overweight to Neutral and slashed the price target from $105.88 to $77.53.

Considering buying ALC stock? Here’s what analysts think:

Read This Next:

- Top 2 Financial Stocks You May Want To Dump In Q3

Photo via Shutterstock