Analog Devices (NASDAQ:ADI) reported better-than-expected fiscal third-quarter results on Wednesday.

The company's quarterly revenue increased 25% year-on-year (Y/Y) to $2.88 billion, beating the analyst consensus estimate of $2.76 billion. Adjusted EPS of $2.05 beat the analyst consensus estimate of $1.95.

"Despite geopolitical challenges, ADI's third-quarter revenue and earnings per share exceeded the high end of our expectations," stated CEO and Chair Vincent Roche. "While tariffs and trade fluctuations are creating market uncertainty, the demand for ADI's products remains robust. The company's relentless focus on cutting-edge innovation positions us to capitalize on the growth of the intelligent physical edge. In addition, our diverse and resilient business model enables ADI to navigate various market conditions and consistently create long-term value for our shareholders."

Analog Devices expects fiscal fourth-quarter 2025 revenue of $2.90 billion-$3.10 billion, above the analyst consensus estimate of $2.81 billion. The company projects quarterly adjusted EPS of $2.12-$2.32 against the analyst consensus estimate of $2.03.

Analog Devices shares gained 6.3% to close at $244.87 on Wednesday.

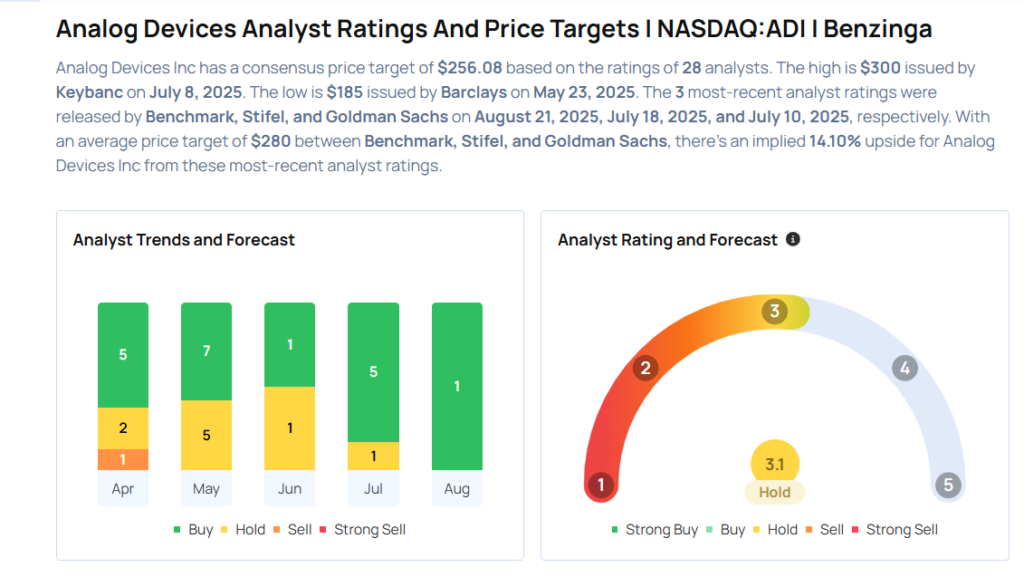

These analysts made changes to their price targets on Analog Devices following earnings announcement.

- Susquehanna analyst Christopher Rolland maintained Analog Devices with a Positive and raised the price target from $280 to $300.

- Benchmark analyst David Williams maintained the stock with a Buy and raised the price target from $260 to $285.

Considering buying ADI stock? Here’s what analysts think:

Read This Next:

- Top 2 Financial Stocks You May Want To Dump In Q3

Photo via Shutterstock