Zoom Communications Inc. (NASDAQ:ZM) reported better-than-expected second-quarter financial results and raised its FY26 guidance above estimates on Thursday.

Zoom reported second-quarter revenue of $1.22 billion, beating the consensus estimate of $1.20 billion. The communications company reported second-quarter adjusted earnings of $1.53 per share, beating analyst estimates of $1.37 per share, according to Benzinga Pro.

"AI is transforming the way we work together, and Zoom is at the forefront, driving innovation that helps people get more done, reduce costs, and deliver better experiences for customers and employees alike," said Eric Yuan, founder and CEO of Zoom.

Zoom expects third-quarter revenue to be in the range of $1.21 billion to $1.215 billion versus estimates of $1.211 billion. The company anticipates third-quarter adjusted earnings of $1.42 to $1.44 per share versus estimates of $1.39 per share.

Zoom expects full-year revenue of $4.825 billion to $4.835 billion versus estimates of $4.81 billion. Full-year earnings are expected to be between $5.81 and $5.84 per share versus estimates of $5.58 per share.

Zoom shares jumped 12.5% to $82.29 on Friday.

These analysts made changes to their price targets on Coty following earnings announcement.

- Rosenblatt analyst Catharine Trebnick maintained Zoom with a Buy and raised the price target from $100 to $110.

- Keybanc analyst Jackson Ader maintained the stock with an Underweight rating and lowered the price target from $73 to $69.

- RBC Capital analyst Rishi Jaluria maintained the stock with an Outperform rating and raised the price target from $95 to $100.

- Baird analyst William Power maintained the stock with an Outperform rating and lowered the price target from $100 to $95.

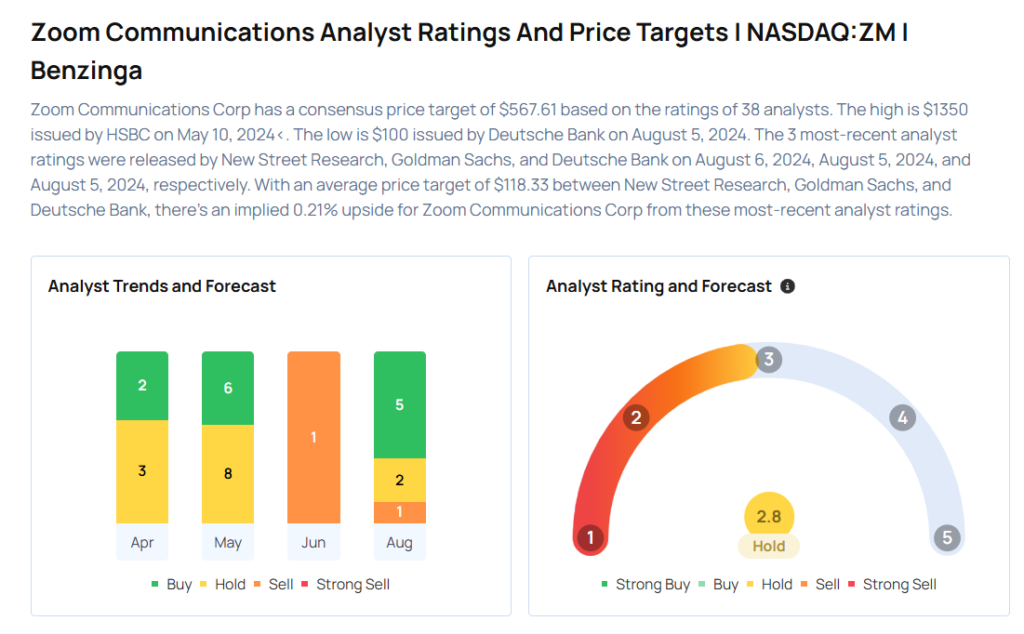

Considering buying ZM stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech Stocks That May Collapse In August

Photo via Shutterstock