Zebra Technologies Corporation (NASDAQ:ZBRA) posted better-than-expected second-quarter earnings and raised its FY 2025 adjusted EPS guidance above estimates.

Zebra Technologies posted adjusted earnings of $3.61 per share, beating market estimates of $3.31 per share. The company's sales came in-line with estimates at $1.29 billion.

Zebra Technologies raised its FY2025 adjusted EPS guidance from $13.75-$14.75 to $15.25-$15.75 and narrowed sales guidance from $5.13 billion-$5.33 billion to $5.23 billion-$5.33 billion.

“Solid demand, excellent execution by our team and lower-than-expected tariffs enabled us to deliver second quarter results that exceeded our expectations,” said Bill Burns, Chief Executive Officer of Zebra Technologies. “We are raising both our sales and profitability outlook for the full year, given our solid first half results and expectation for second half growth. Looking ahead, we are focused on driving shareholder value and advancing our industry leadership with our innovative solutions that digitize and automate our customers’ workflows.”

Zebra Technologies shares fell 11.4% to close at $302.60 on Tuesday.

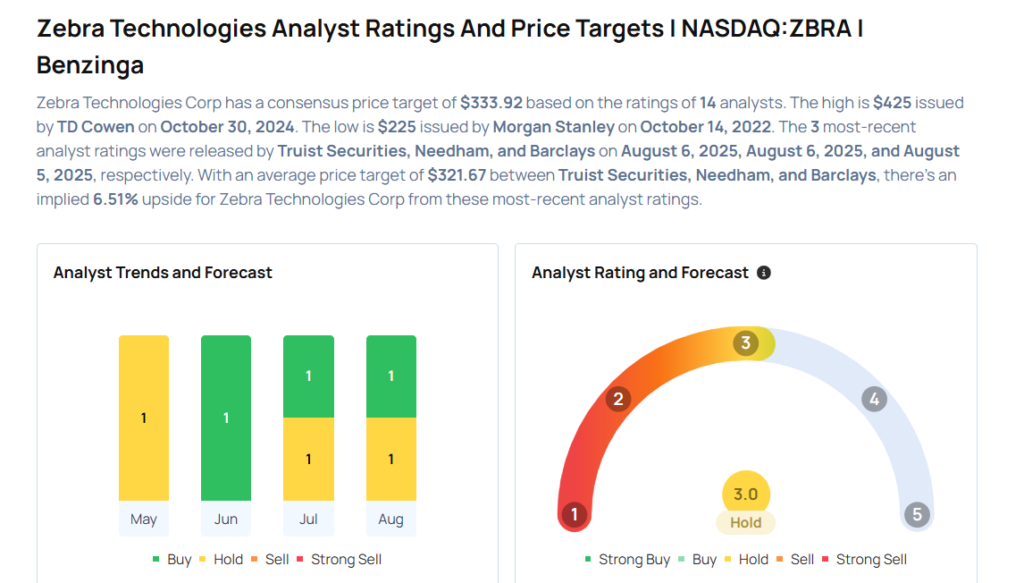

These analysts made changes to their price targets on Zebra Technologies following earnings announcement.

- Needham analyst James Ricchiuti maintained Zebra Technologies with a Buy and raised the price target from $325 to $345.

- Truist Securities analyst Jamie Cook maintained Zebra Technologies with a Hold and raised the price target from $269 to $319.

Considering buying ZBRA stock? Here’s what analysts think:

Read This Next:

- Top 2 Health Care Stocks You May Want To Dump In Q3

Photo via Shutterstock