W.W. Grainger, Inc. (NYSE:GWW) reported weaker-than-expected earnings for the second quarter on Friday.

The company posted quarterly earnings of $9.97 per share which missed the analyst consensus estimate of $10.04 per share. The company reported quarterly sales of $4.554 billion which beat the analyst consensus estimate of $4.522 billion.

W.W. Grainger lowered its FY2025 GAAP EPS guidance from $39.00-$41.50 to $38.50-$40.25, but raised its sales guidance from $17.600 billion-$18.100 billion to $17.900 billion-$18.200 billion.

“Our team remains focused on our customers, fostering deep relationships, providing exceptional service and driving innovation through differentiated capabilities,” said D.G. Macpherson, Chairman and CEO. “Our headline results for the quarter finished largely in-line with communicated expectations, although performance was impacted by some tariff-related factors which are also flowing into our updated outlook. Even amid ongoing macroeconomic uncertainty, our commitment to our customers remains steadfast, and we’re well-positioned to continue creating value for all stakeholders.”

W.W. Grainger shares fell 0.3% to trade at $929.96 on Monday.

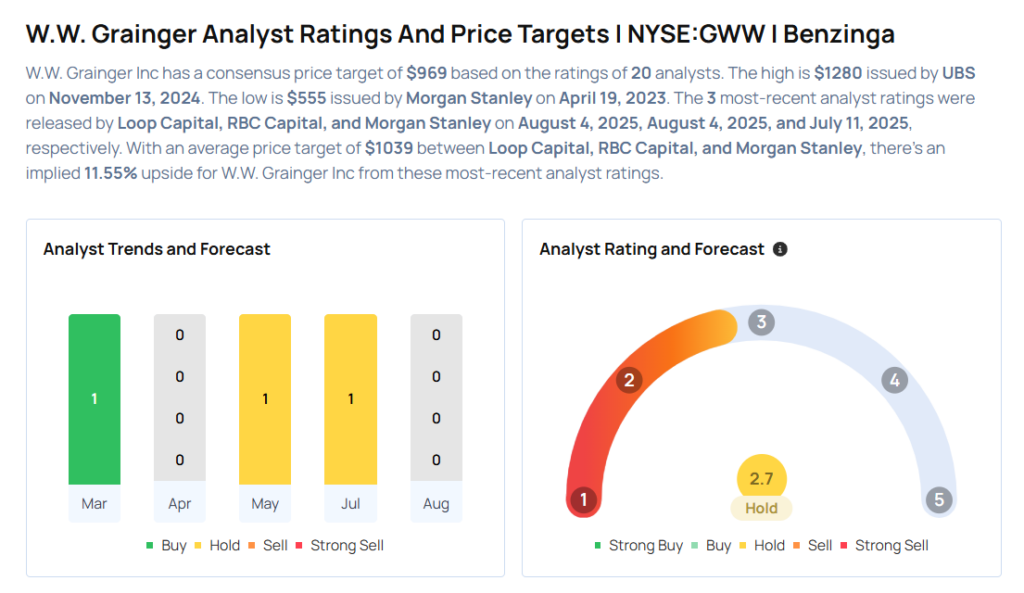

These analysts made changes to their price targets on W.W. Grainger following earnings announcement.

- RBC Capital analyst Deane Dray maintained W.W. Grainger with a Sector Perform and lowered the price target from $1,176 to $1,007.

- Loop Capital analyst Chris Dankert maintained the stock with a Hold and lowered the price target from $1,000 to $950.

Considering buying GWW stock? Here’s what analysts think:

Read This Next:

- Top 2 Financial Stocks That May Collapse This Month

Photo via Shutterstock