Axsome Therapeutics, Inc. (NASDAQ:AXSM) reported better-than-expected second-quarter financial results on Monday.

Axsome Therapeutics reported quarterly losses of 47 cents per share compared to analyst consensus estimate of losses of $1.07 per share. The company reported quarterly sales of $150.04 million which beat the analyst consensus estimate of $140.33 million.

“Axsome delivered robust second quarter performance, reflecting strong underlying demand for our life-changing medicines, exacting commercial execution, solid regulatory progress, and continued advancement of our differentiated neuroscience pipeline. We are excited by the recent approval and launch of SYMBRAVO for migraine, and are pleased with the accelerating performance of AUVELITY for depression and SUNOSI for excessive daytime sleepiness,” said Herriot Tabuteau, MD, Chief Executive Officer of Axsome Therapeutics.

Axsome Therapeutics shares fell 3.4% to trade at $102.89 on Tuesday.

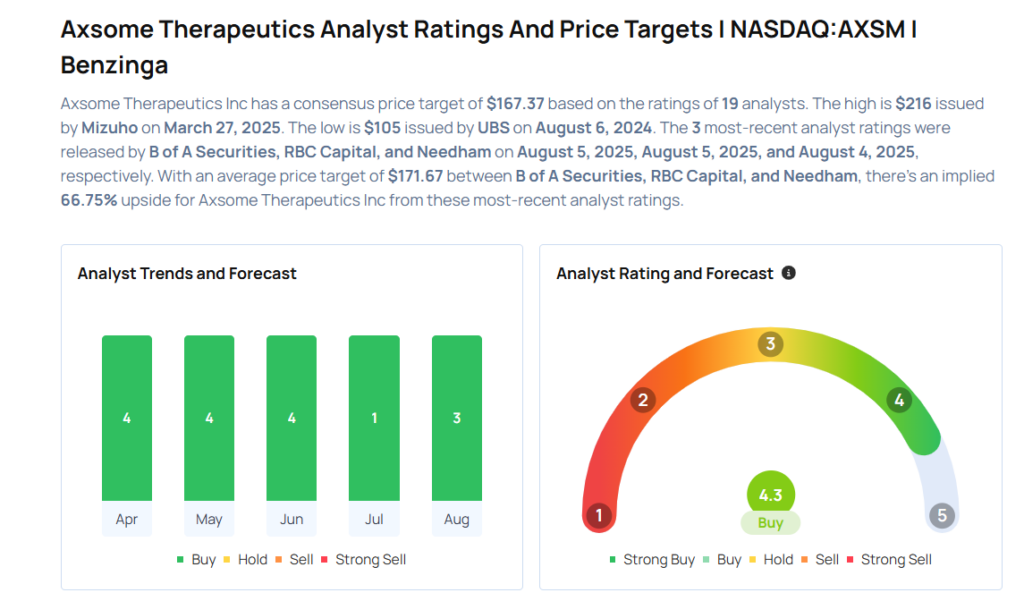

These analysts made changes to their price targets on Axsome Therapeutics following earnings announcement.

- RBC Capital analyst Leonid Timashev maintained Axsome Therapeutics with an Outperform rating and raised the price target from $184 to $189.

- B of A Securities analyst Jason Gerberry maintained the stock with a Buy and raised the price target from $173 to $176.

Considering buying AXSM stock? Here’s what analysts think:

Read This Next:

- Top 2 Financial Stocks That May Collapse This Month

Photo via Shutterstock