Pegasystems Inc. (NASDAQ:PEGA) reported better-than-expected financial results for the second quarter, after the closing bell on Tuesday.

Pegasystems reported quarterly earnings of 28 cents per share which beat the analyst consensus estimate of 23 cents per share. The company reported quarterly sales of $384.512 million which beat the analyst consensus estimate of $362.588 million.

“Our unique approach to AI was a key driver of our strong first half results,” said Alan Trefler, Pega founder and CEO. “Pega harnesses AI’s creative potential where it can best drive transformation—during workflow design with Pega Blueprint. This drives consistent execution through our state-of-the-art Pega Infinity workflow engine, rather than through inherently unpredictable prompts. Pega’s Predictable AI approach gives enterprises both the innovation they crave and the operational consistency they require.”

Pegasystems shares fell 1.1% to trade at $57.40 on Thursday.

These analysts made changes to their price targets on Pegasystems following earnings announcement.

- Rosenblatt analyst Blair Abernethy maintained Pegasystems with a Buy and raised the price target from $59 to $61.

- Wedbush analyst Daniel Ives maintained the stock with an Outperform rating and raised the price target from $68 to $70.

- Citigroup analyst Steven Enders maintained the stock with a Buy and raised the price target from $66 to $70.

- DA Davidson analyst William Jellison maintained Pegasystems with a Neutral and raised the price target from $50 to $60.

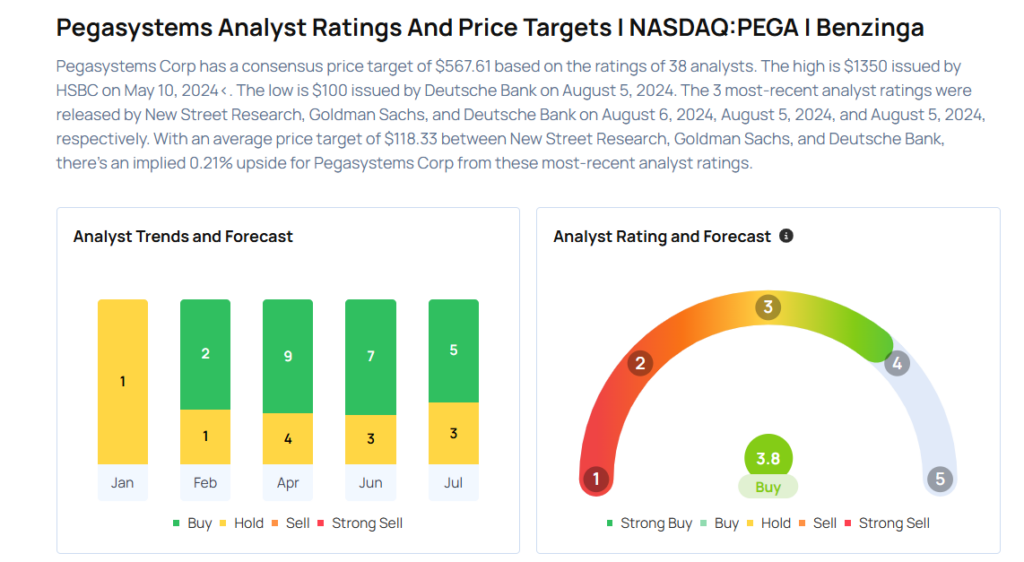

Considering buying PEGA stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Loves ‘That Yield’ But Passes On This Stock: ‘Fundamentals Are Hurting’

Photo via Shutterstock