Verizon Communications Inc. (NYSE:VZ) will release earnings results for the second quarter, before the opening bell on Monday, July 21.

Analysts expect the New York-based company to report quarterly earnings at $1.20 per share. It reported $1.15 per share in the previous year. Verizon is also projected to report quarterly revenue of $33.55 billion. Compare that to $32.8 billion a year earlier, according to data from Benzinga Pro.

Verizon Business, Thames Freeport, and Nokia Corp. (NYSE:NOK) on June 25 announced a partnership to deploy Verizon Private 5G Networks across multiple key logistics, manufacturing, and innovation sites along the River Thames Estuary in U.K.

Verizon shares fell 0.3% to close at $40.84 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

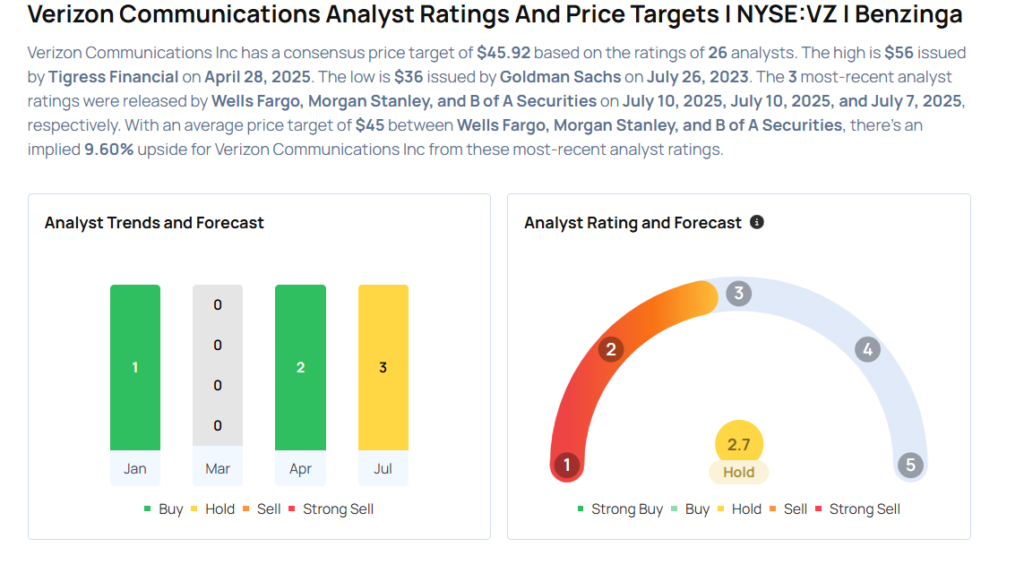

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wells Fargo analyst Eric Luebchow maintained an Equal-Weight rating and raised the price target from $42 to $43 on July 10, 2025. This analyst has an accuracy rate of 63%.

- Morgan Stanley analyst Benjamin Swinburne reinstated an Equal-Weight rating and a price target from $47 on July 10, 2025. This analyst has an accuracy rate of 76%.

- Tigress Financial analyst Ivan Feinseth maintained a Buy rating and raised the price target from $55 to $56 on April 28, 2025. This analyst has an accuracy rate of 75%.

- Scotiabank analyst Maher Yaghi maintained a Sector Perform rating and increased the price target from $48.5 to $49 on April 23, 2025. This analyst has an accuracy rate of 63%.

- Oppenheimer analyst Timothy Horan maintained an Outperform and raised the price target from $48 to $50 on April 1, 2025. This analyst has an accuracy rate of 73%

Considering buying VZ stock? Here’s what analysts think:

Read This Next:

- Top 2 Energy Stocks That May Fall Off A Cliff This Quarter

Photo via Shutterstock