Philip Morris International Inc. (NYSE:PM) will release earnings results for the second quarter before the opening bell on Tuesday, July 22.

Analysts expect the Stamford, Connecticut-based company to report quarterly earnings at $1.86 per share, up from $1.59 per share in the year-ago period. Philip Morris is projected to report quarterly revenue of $10.33 billion, compared to $9.47 billion a year earlier, according to data from Benzinga Pro.

On June 13, Philip Morris International declared a regular quarterly dividend of $1.35 per share.

Philip Morris shares gained 1% to close at $180.48 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

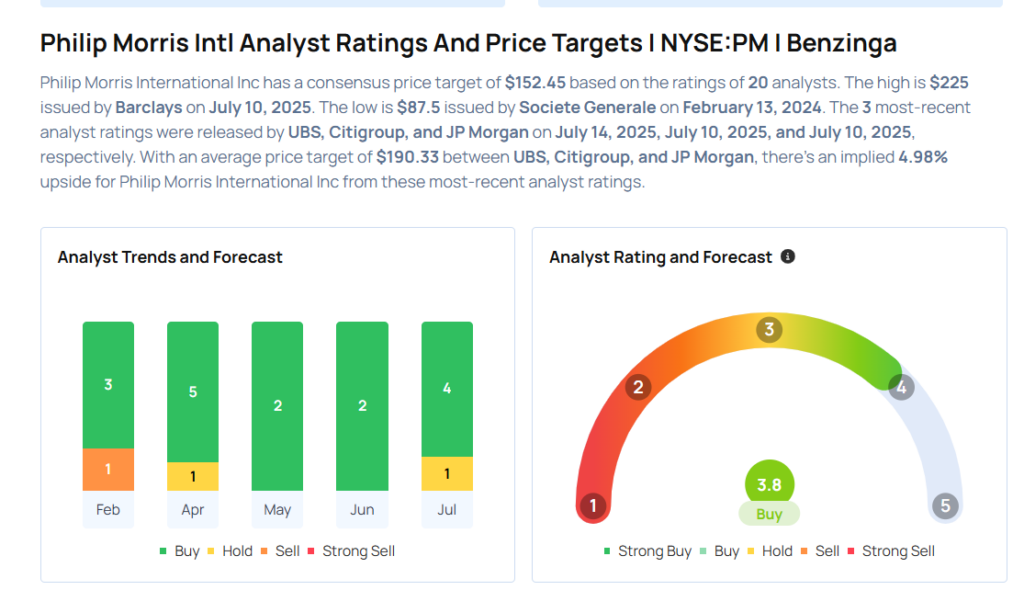

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Citigroup analyst Simon Hales maintained a Buy rating and raised the price target from $188 to $200 on July 10, 2025. This analyst has an accuracy rate of 60%.

- JP Morgan analyst Jared Dinges maintained an Overweight rating and raised the price target from $175 to $190 on July 10, 2025. This analyst has an accuracy rate of 71%.

- Barclays analyst Gaurav Jain maintained an Overweight rating and increased the price target from $220 to $225 on July 10, 2025. This analyst has an accuracy rate of 66%.

- B of A Securities analyst Lisa Lewandowski maintained a Buy rating and raised the price target from $182 to $200 on June 4, 2025. This analyst has an accuracy rate of 66%.

- Stifel analyst Matthew Smith maintained a Buy rating and increased the price target from $168 to $186 on April 24, 2025. This analyst has an accuracy rate of 60%

Considering buying PM stock? Here’s what analysts think:

Read This Next:

- Top 2 Financial Stocks That May Plunge This Month

Photo via Shutterstock