Preferred Bank (NASDAQ:PFBC) reported better-than-expected earnings for the second quarter on Monday.

The company posted quarterly earnings of $2.52 per share which beat the analyst consensus estimate of $2.42 per share. The company reported quarterly sales of $66.87 million which beat the analyst consensus estimate of $66.72 million.

Li Yu, Chairman and CEO, commented, “We are pleased to report our results for the second quarter of 2025. We recorded net income of $32.8 million or $2.52 per fully diluted share. This quarter we had an increase in our loan portfolio of 1.8% (linked quarter), however, deposits only increased slightly. The Bank’s net interest margin improved to 3.85%. Last quarter we reported a net interest margin of 3.75% which was negatively impacted by an outsized interest reversal.”

Preferred Bank shares gained 0.6% to trade at $97.60 on Tuesday.

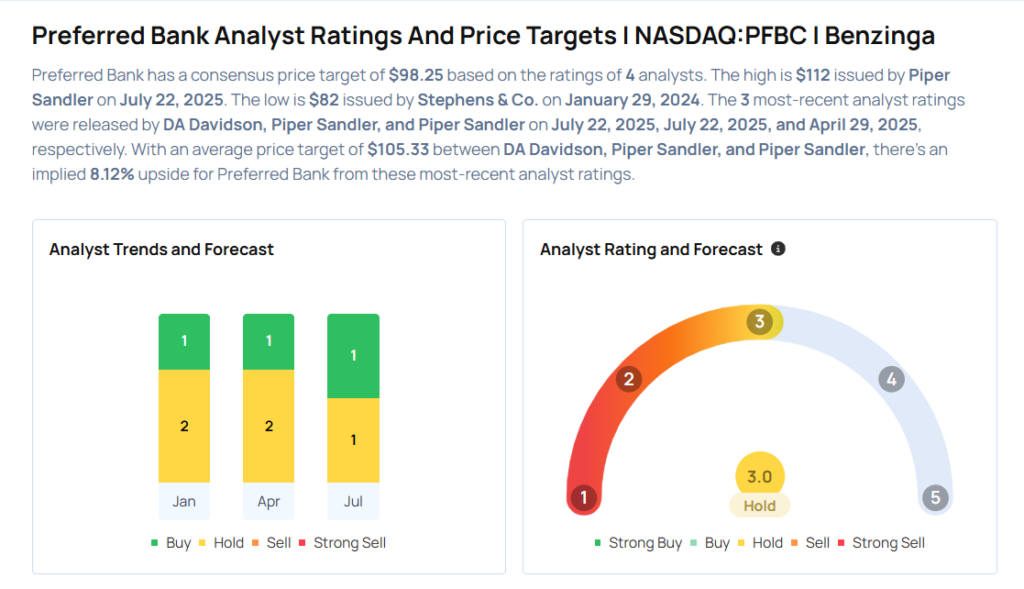

These analysts made changes to their price targets on Preferred Bank following earnings announcement.

- Piper Sandler analyst Matthew Clark maintained Preferred Bank with an Overweight rating and raised the price target from $96 to $112.

- DA Davidson analyst Gary Tenner maintained the stock with a Neutral and raised the price target from $90 to $108.

Considering buying PFBC stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From AT&T Stock Ahead Of Q2 Earnings

Photo via Shutterstock