American Express Company (NYSE:AXP) will release earnings results for the second quarter, before the opening bell on Friday, July 18.

Analysts expect the New York-based company to report quarterly earnings at $3.86 per share. It reported $4.15 per share in the previous year. American Express is also projected to report quarterly revenue of $17.7 billion. Compare that to $16.33 billion a year earlier, according to data from Benzinga Pro.

On June 17, the company's board declared a regular quarterly dividend of 82 cents per common share.

American Express shares gained 1.1% to close at $315.35 on Thursday.

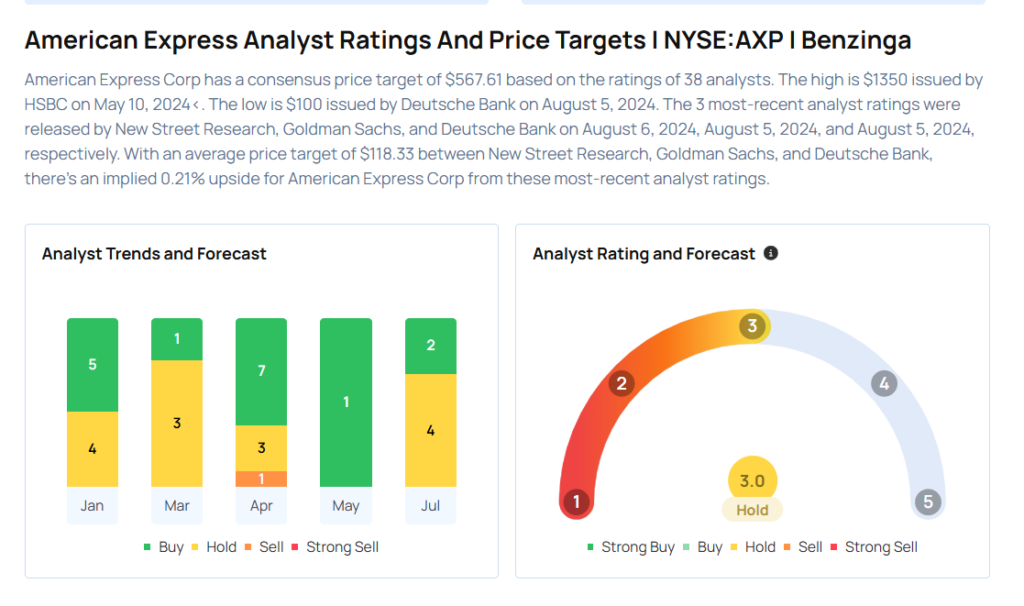

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Richard Shane maintained a Neutral rating and raised the price target from $260 to $342 on July 11, 2025. This analyst has an accuracy rate of 66%.

- Morgan Stanley analyst Betsy Graseck maintained an Equal-Weight rating and increased the price target from $250 to $311 on July 10, 2025. This analyst has an accuracy rate of 61%.

- Keefe, Bruyette & Woods analyst Sanjay Sakhrani maintained an Outperform rating and raised the price target from $360 to $371 on July 9, 2025. This analyst has an accuracy rate of 61%.

- Truist Securities analyst Brian Foran maintained a Buy rating and increased the price target from $375 to $340 on July 9, 2025. This analyst has an accuracy rate of 68%.

- Citigroup analyst Keith Horowitz maintained a Neutral and raised the price target from $300 to $327 on July 2, 2025. This analyst has an accuracy rate of 77%

Considering buying AXP stock? Here’s what analysts think:

Read This Next:

- Top 2 Defensive Stocks That Are Ticking Portfolio Bombs

Photo via Shutterstock