M&T Bank Corporation (NYSE:MTB) will release earnings results for the second quarter, before the opening bell on Wednesday, July 16.

Analysts expect the Buffalo, New York-based company to report quarterly earnings at $4.00 per share, up from $3.79 per share in the year-ago period. M&T Bank projects to report quarterly revenue at $2.39 billion, compared to $2.3 billion a year earlier, according to data from Benzinga Pro.

On June 5, M&T Bank and the Galesi Group launched a major partnership that will expand their collaborative efforts to accelerate and sustain the revitalization of Schenectady’s Mohawk Harbor.

M&T Bank shares rose 1.8% to close at $204.05 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

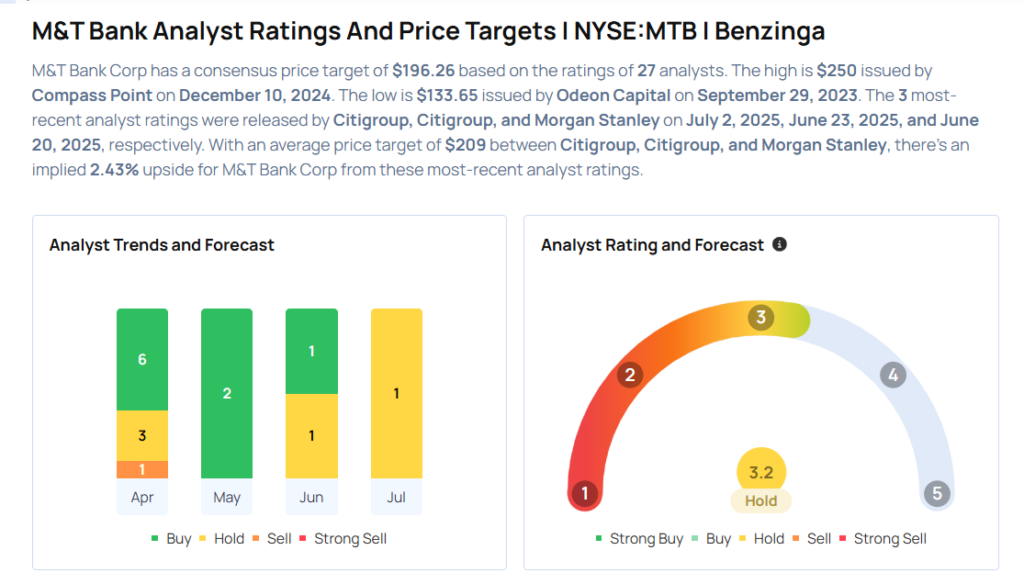

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Citigroup analyst Keith Horowitz maintained a Neutral rating and raised the price target from $200 to $212 on July 2, 2025. This analyst has an accuracy rate of 79%.

- Morgan Stanley analyst Manan Gosalia maintained an Overweight rating and boosted the price target from $206 to $215 on June 20, 2025. This analyst has an accuracy rate of 76%.

- RBC Capital analyst Gerard Cassidy reiterated an Outperform rating with a price target of $200 on May 19, 2025. This analyst has an accuracy rate of 77%.

- Truist Securities analyst Brian Foran maintained a Buy rating and cut the price target from $225 to $200 on April 15, 2025. This analyst has an accuracy rate of 76%.

- RBC Capital analyst Brad Erickson maintained an Outperform rating and cut the price target from $208 to $200 on April 15, 2025. This analyst has an accuracy rate of 74%.

Considering buying MTB stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From JPMorgan Stock Ahead Of Q2 Earnings

Photo via Shutterstock