General Mills, Inc. (NYSE:GIS) posted mixed fourth-quarter results and issued a cautious full-year outlook on Wednesday.

The global packaged food company registered quarterly adjusted earnings per share of 74 cents, beating the analyst consensus estimate of 71 cents. Quarterly sales of $4.56 billion (down 3% year over year) missed the Street view of $4.59 billion.

"Our number one goal in fiscal 2026 is to restore volume-driven organic sales growth," said General Mills Chairman and Chief Executive Officer Jeff Harmening. "To do that, we'll invest further in consumer value, product news, innovation, and brand building, guided by our remarkable experience framework and highlighted by Blue Buffalo's national launch into fresh pet food coming later in calendar 2025."

General Mills expects its fiscal 2026 adjusted diluted EPS to decline 10%-15% in constant currency from the fiscal year 2025 base of $4.21. The company projects organic net sales to range between a 1% decline and a 1% increase.

General Mills shares rose 1.4% to trade at $51.40 on Thursday.

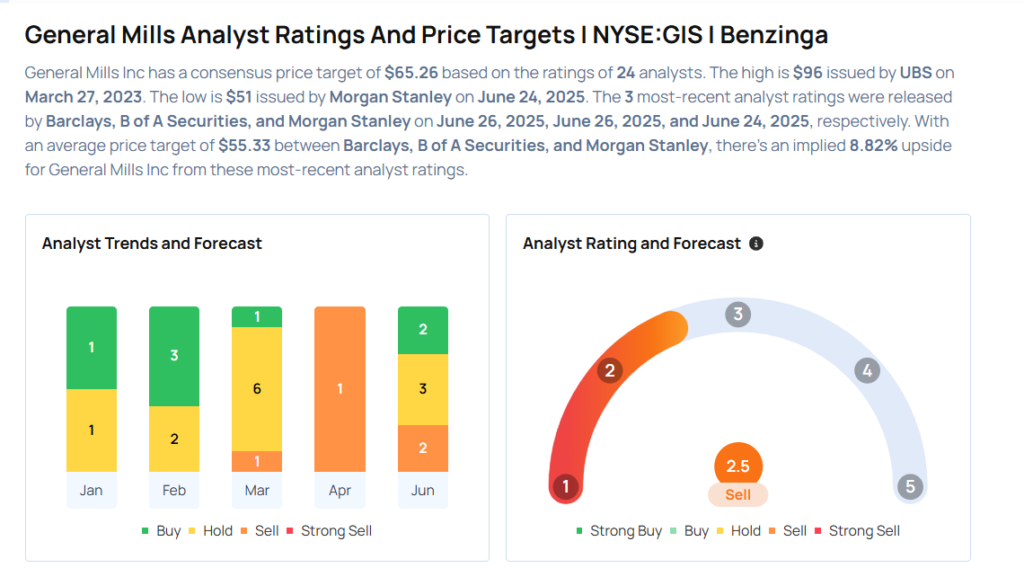

These analysts made changes to their price targets on General Mills following earnings announcement.

- B of A Securities analyst Bryan Spillane maintained General Mills with a Buy and lowered the price target from $63 to $61.

- Barclays analyst Andrew Lazar maintained the stock with an Equal-Weight rating and cut the price target from $60 to $54.

Considering buying GIS stock? Here’s what analysts think:

Read This Next:

- Top 2 Utilities Stocks That May Fall Off A Cliff In Q2

Photo via Shutterstock