Darden Restaurants Inc. (NYSE:DRI) reported better-than-expected fourth-quarter financial results on Friday.

The company reported fourth-quarter adjusted earnings per share of $2.98, beating the analyst consensus estimate of $2.97. Quarterly sales of $3.27 billion outpaced the analyst consensus estimate of $3.26 billion.

Darden reported a consolidated same-restaurant sales increase of 4.6%, with Olive Garden and LongHorn Steakhouse rising 6.9% and 6.7%, respectively. Fine Dining saw a decline of 3.3%, while Other Business grew by 1.2%.

“We had a strong quarter with same-restaurant sales and earnings growth that exceeded our expectations,” said Darden President & CEO Rick Cardenas. “Our adherence to our winning strategy, anchored in our four competitive advantages and being brilliant with the basics, led to a successful year. Our strategy remains the right one for the company, and we will continue to execute it to drive growth and long-term shareholder value.”

Darden Restaurants expects fiscal 2026 adjusted EPS between $10.50 and $10.70, below the $10.75 consensus estimate. The company projects total sales growth of 7% to 8% for the year.

Darden shares fell 5.1% to trade at $214.17 on Monday.

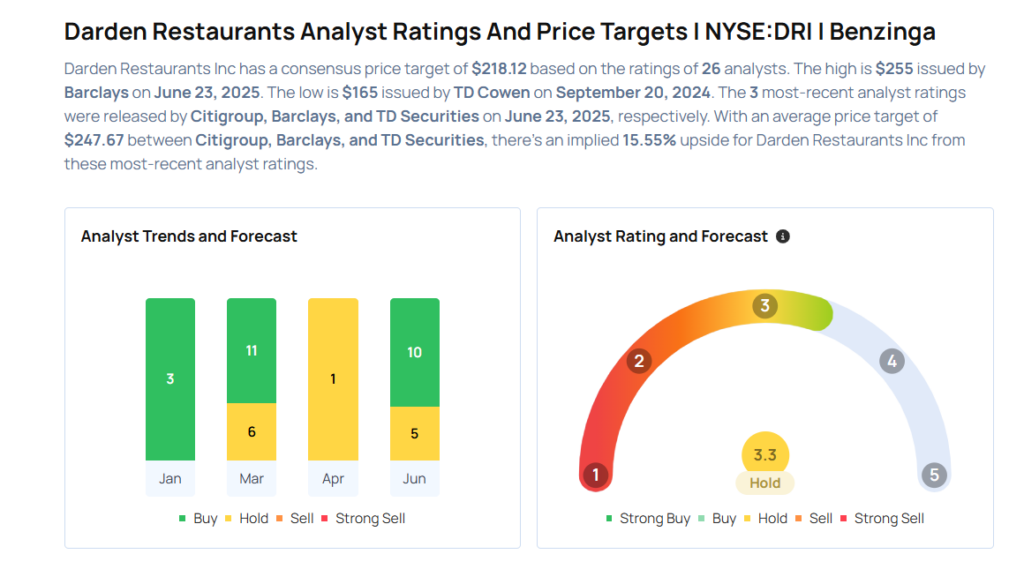

These analysts made changes to their price targets on Darden following earnings announcement.

- Stephens & Co. analyst Jim Salera maintained Darden Restaurants with an Equal-Weight rating and raised the price target from $200 to $212.

- Baird analyst David Tarantino maintained Darden Restaurants with a Neutral and raised the price target from $218 to $230.

- Keybanc analyst Eric Gonzalez maintained the stock with an Overweight rating and raised the price target from $230 to $245.

- B of A Securities analyst Sara Senatore maintained Darden Restaurants with a Buy and raised the price target from $252 to $253.

- TD Securities analyst Andrew Charles maintained the stock with a Hold and boosted the price target from $215 to $235.

- Barclays analyst Jeffrey Bernstein maintained Darden Restaurants with an Overweight rating and raised the price target from $235 to $255.

- Citigroup analyst Jon Tower maintained the stock with a Buy and raised the price target from $245 to $253.

Considering buying DRI stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech Stocks That Could Sink Your Portfolio In June

Photo via Shutterstock