Commercial Metals Company (NYSE:CMC) will release earnings results for the third quarter, before the opening bell on Monday, June 23.

Analysts expect the Irving, Texas-based company to report quarterly earnings at 84 cents per share, down from $1.02 per share in the year-ago period. Commercial Metals projects to report quarterly revenue of $2.04 billion, compared to $2.08 billion a year earlier, according to data from Benzinga Pro.

On March 20, Commercial Metals reported second-quarter 2025 results on Thursday, with net sales down 5.1% year-over-year to $1.754 billion, broadly in line with the analyst expectations of $1.746 billion.

Commercial Metals shares rose 0.2% to close at $49.04 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wolfe Research analyst Timna Tanners upgraded the stock from Peer Perform to Outperform on May 27, 2025. This analyst has an accuracy rate of 67%.

- UBS analyst Curt Woodworth maintained a Neutral rating and cut the price target from $54 to $49 on March 24, 2025. This analyst has an accuracy rate of 66%.

- Morgan Stanley analyst Piyush Sood maintained an Equal-Weight rating and slashed the price target from $56 to $53 on March 7, 2025. This analyst has an accuracy rate of 73%.

- Jefferies analyst Seth Rosenfeld maintained a Buy rating and cut the price target from $65 to $62 on Jan. 6, 2025. This analyst has an accuracy rate of 67%.

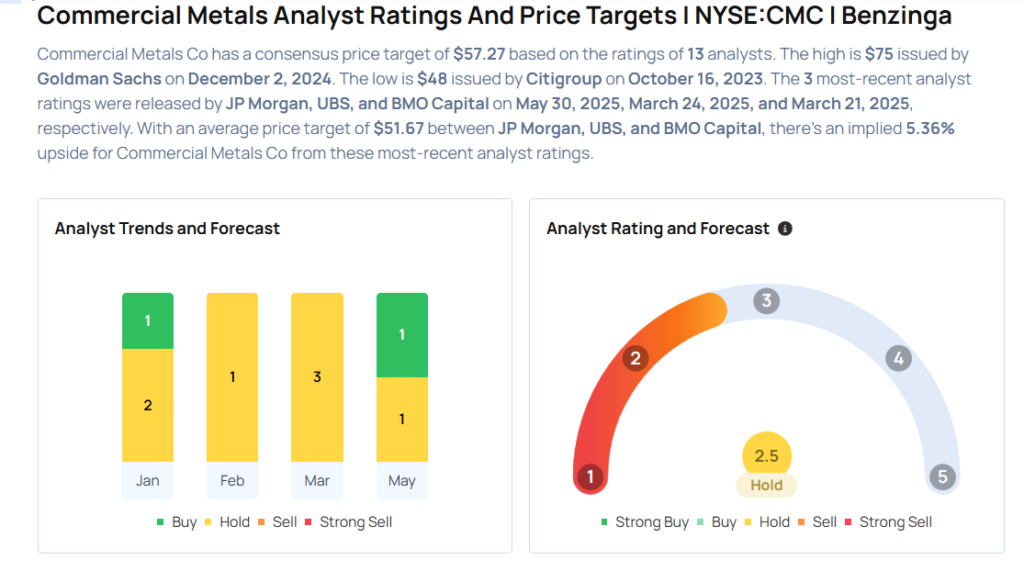

Considering buying CMC stock? Here’s what analysts think:

Read This Next:

- Top 2 Industrials Stocks That May Fall Off A Cliff In Q2

Photo via Shutterstock