The Lovesac Company (NASDAQ:LOVE) will release its first-quarter financial results before the opening bell on Thursday, June 12.

Analysts expect the Stamford, Connecticut-based company to report a quarterly loss at 71 cents per share, versus a year-ago loss of 63 cents per share in the year-ago period. Lovesac projects quarterly revenue of $137.47 million, compared to $132.64 million a year earlier, according to data from Benzinga Pro.

On April 10, the company reported a fourth-quarter FY25 revenue decline of 3.6% year-on-year to $241.490 million, beating the analyst consensus estimate of $233.954 million.

Lovesac shares fell 1.9% to close at $20.50 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

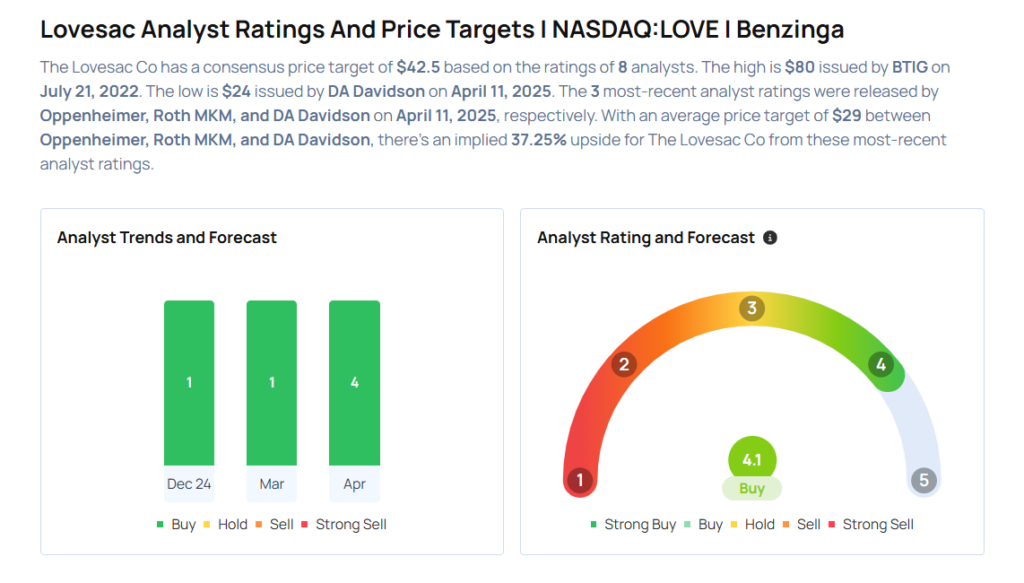

- Oppenheimer analyst Brian Nagel maintained an Outperform rating with a price target of $35 on April 11, 2025. This analyst has an accuracy rate of 68%.

- Roth MKM analyst Matt Koranda maintained a Buy rating and raised the price target from $22 to $28 on April 11, 2025. This analyst has an accuracy rate of 62%.

- DA Davidson analyst Tim Forte maintained a Buy rating and cut the price target from $35 to $24 on April 11, 2025. This analyst has an accuracy rate of 76%.

- Canaccord Genuity analyst Maria Ripps maintained a Buy rating and slashed the price target from $45 to $30 on April 11, 2025. This analyst has an accuracy rate of 74%.

Considering buying LOVE stock? Here’s what analysts think:

Read This Next:

- Top 2 Consumer Stocks That May Plunge In June

Photo via Shutterstock