Oracle Corporation (NYSE:ORCL) will release earnings results for the fourth quarter, after the closing bell on Wednesday, June 11.

Analysts expect the Austin, Texas-based company to report quarterly earnings at $1.64 per share, up from $1.63 per share in the year-ago period. Oracle projects to report quarterly revenue at $15.59 billion, compared to $14.29 billion a year earlier, according to data from Benzinga Pro.

The company has missed revenue estimates in two straight quarters and missed estimates in seven of the past 10 quarters overall.

Oracle shares gained 0.2% to close at $177.48 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

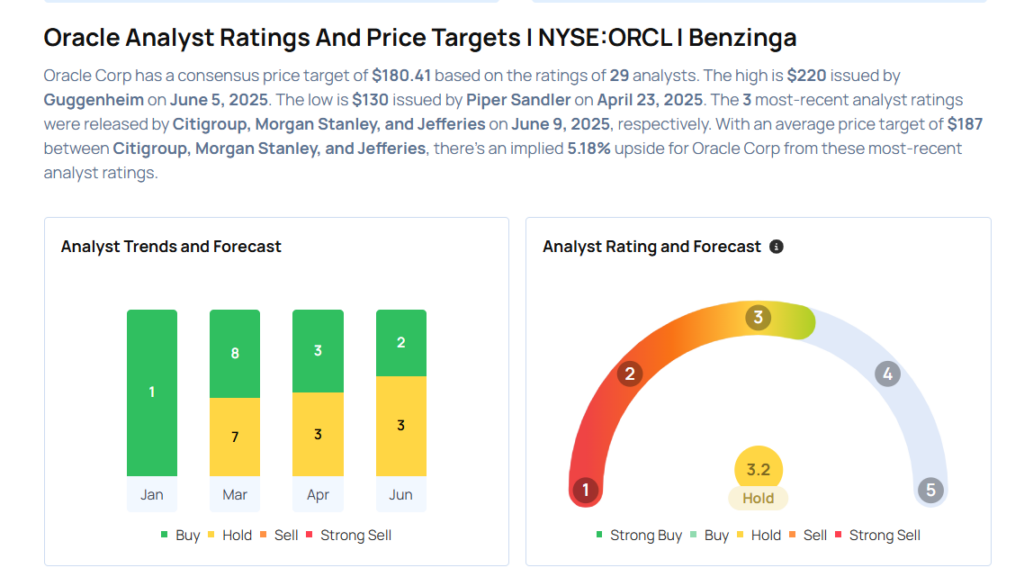

- Citigroup analyst Tyler Radke maintained a Neutral rating and raised the price target from $160 to $186 on June 9, 2025. This analyst has an accuracy rate of 71%.

- Morgan Stanley analyst Keith Weiss maintained an Equal-Weight rating and increased the price target from $160 to $175 on June 9, 2025. This analyst has an accuracy rate of 76%.

- Jefferies analyst Brent Thill maintained a Buy rating and increased the price target from $190 to $200 on June 9, 2025. This analyst has an accuracy rate of 77%.

- BMO Capital analyst Keith Bachman maintained a Market Perform rating and increased the price target from $175 to $200 on June 9, 2025. This analyst has an accuracy rate of 83%.

- Guggenheim analyst John Difucci reiterated a Buy rating with a price target of $220 on June 5, 2025. This analyst has an accuracy rate of 70%.

Considering buying ORCL stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech And Telecom Stocks You May Want To Dump In Q2

Photo via Shutterstock