ServiceTitan, Inc. (NASDAQ:TTAN) reported mixed first-quarter results on Thursday.

ServiceTitan posted adjusted earnings of 18 cents per share, beating market estimates of 12 cents per share. The company's quarterly sales came in at $215.69 million versus expectations of $208.69 million.

The company raised its FY2026 sales guidance from $895.00 million-$905.00 million to $910.00 million-$920.00 million.

“The ROI we deliver to our customers continues to be our greatest advantage,” said Vahe Kuzoyan, Co-Founder and President, “We’re building a series of stacking S-curves to put ourselves in a position to deliver transformative customer outcomes, and each of our four primary areas of focus this year are off to a strong start.”

ServiceTitan shares dipped 7.7% to trade at $105.68 on Friday.

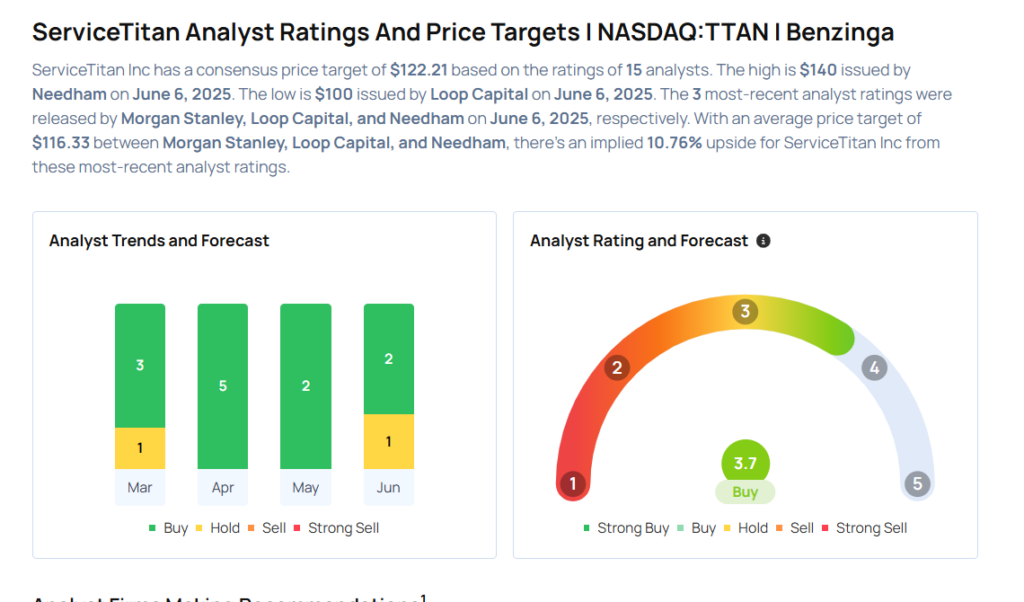

These analysts made changes to their price targets on ServiceTitan following earnings announcement.

- Morgan Stanley analyst Josh Baer maintained ServiceTitan with an Equal-Weight rating and raised the price target from $107 to $109.

- Loop Capital analyst Yun Kim maintained the stock with a Hold and raised the price target from $90 to $100.

- Needham analyst Scott Berg reiterated ServiceTitan with a Buy and maintained a $140 price target.

Considering buying TTAN stock? Here’s what analysts think:

Read This Next:

- Top 2 Energy Stocks That May Fall Off A Cliff In Q2

Photo via Shutterstock