MongoDB, Inc. (NASDAQ:MDB) will release its first-quarter financial results after the closing bell on Wednesday, June 4.

Analysts expect the New York-based company to report quarterly earnings at 66 cents per share, up from 51 cents per share in the year-ago period. MongoDB projects quarterly revenue of $527.48 million, compared to $450.56 million a year earlier, according to data from Benzinga Pro.

On March 5, MongoDB reported quarterly earnings of $1.28 per share, which beat the analyst consensus estimate of 66 cents.

MongoDB shares gained 0.4% to close at $193.75 on Tuesday.

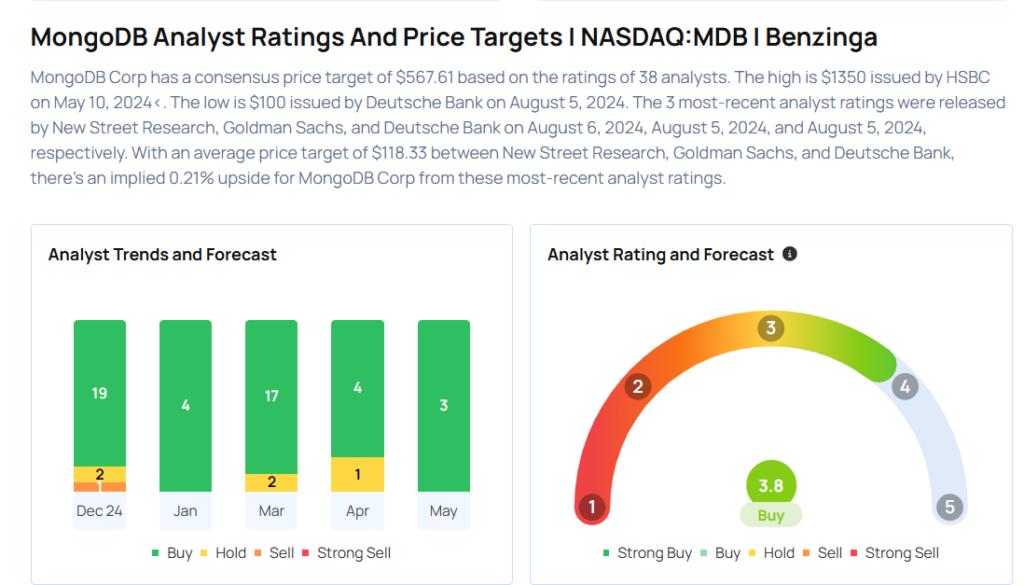

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Loop Capital analyst Yun Kim downgraded the stock from Buy to Hold and cut the price target from $350 to $190 on May 20, 2025. This analyst has an accuracy rate of 78%.

- Barclays analyst Raimo Lenschow maintained an Overweight rating and cut the price target from $280 to $252 on May 16, 2025. This analyst has an accuracy rate of 71%.

- Scotiabank analyst Patrick Colville maintained a Sector Perform rating and cut the price target from $240 to $160 on April 25, 2025. This analyst has an accuracy rate of 62%.

- Piper Sandler analyst Brent Bracelin maintained an Overweight rating and cut the price target from $280 to $200 on April 23, 2025. This analyst has an accuracy rate of 75%.

- Stifel analyst Brad Reback maintained a Buy rating and cut the price target from $340 to $275 on April 11, 2025. This analyst has an accuracy rate of 75%

Considering buying MDB stock? Here’s what analysts think:

Read This Next:

- Cramer: Should’ve Told Investors To ‘Pull The Trigger’ On Trade Desk, Can’t Believe ‘How Low’ Gentex Has Fallen

Photo via Shutterstock