The Campbell's Company (NASDAQ:CPB) posted better-than-expected third-quarter results on Monday.

The company reported third-quarter sales growth of 4% year over year (Y/Y) to $2.475 billion, beating the analyst consensus estimate of $2.43 billion. Adjusted EPS of $0.73 beat the consensus estimate of $0.66.

For FY25, Campbell reiterated net sales growth of 6% to 8% and adjusted EBIT growth of 3% to 5%. The company reaffirmed adjusted EPS guidance of $2.95 – $3.05 vs. the consensus estimate of $2.98.

Excluding the impact of tariffs, the company now expects adjusted EBIT and adjusted EPS to be at the low end of the guided range owing to the slower-than-anticipated recovery in the Snacks business. Assuming current tariffs hold steady, the company estimates that the net incremental headwind on adjusted EPS could be up to $0.03 to $0.05 per share.

Mick Beekhuizen, Campbell’s President and CEO said, “We delivered solid third quarter results that exceeded our expectations partially due to favorable shipment timing. In Meals & Beverages, we are seeing improved consumption across all consumer income groups. Consumers are cooking at home at the highest levels since early 2020 and turning to our brands for value, quality, and convenience. Within Snacks, performance was mixed across the portfolio, and while we’re benefiting from some strong innovation launches, we are adjusting our plans to make sure we’re competitive across our full brand portfolio. Our overall performance reflects our strong execution and disciplined cost management in what remains a dynamic operating environment. We continue to evolve our organization and capabilities to better leverage our scale for growth and drive long-term value creation.”

Campbell's shares fell 1.9% to trade at $33.61 on Tuesday.

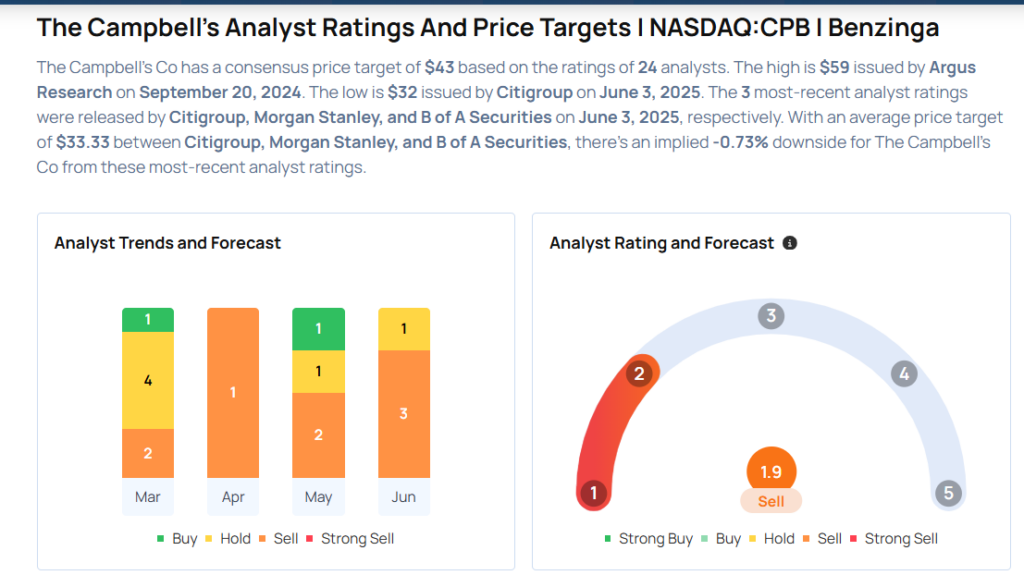

These analysts made changes to their price targets on Campbell's following earnings announcement.

- Barclays analyst Andrew Lazar maintained Campbell’s with an Underweight rating and lowered the price target from $40 to $35.

- B of A Securities analyst Peter Galbo maintained the stock with an Underperform rating and lowered the price target from $37 to $33.

- Morgan Stanley analyst Megan Alexander maintained Campbell’s with an Equal-Weight rating and lowered the price target from $40 to $35.

- Citigroup analyst Thomas Palmer maintained the stock with a Sell and lowered the price target from $33 to $32.

Considering buying CPB stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Tech And Telecom Stocks Delivering High-Dividend Yields

Photo via Shutterstock