Science Applications International Corporation (NASDAQ:SAIC) reported weaker-than-expected earnings for the first quarter on Monday.

Science Applications Intl posted adjusted earnings of $1.92 per share, missing market estimates of $2.22 per share. The company posted quarterly sales of $1.88 billion versus expectations of $1.87 billion.

“Our performance in the first quarter reflects the steady progress we are making against our enterprise growth strategy despite a still dynamic operating environment,” said Toni Townes-Whitley, SAIC Chief Executive Officer. “As a premier mission integrator, the rapid evolution of new technologies, a renewed focus on deploying software to drive efficiency, and an elevated global threat environment create significant opportunities for SAIC. I am confident that SAIC is prepared and well aligned with these macro trends to drive value for our customers, employees, and shareholders.”

Science Applications reiterated the 2026 revenue outlook of $7.60 billion-$7.75 billion, below the analyst consensus estimate of $7.93 billion. The company maintained an annual adjusted EPS outlook of $9.10-$9.30 below the analyst consensus estimate of $10.24.

SAIC shares jumped 2.7% to trade at $102.95 on Tuesday.

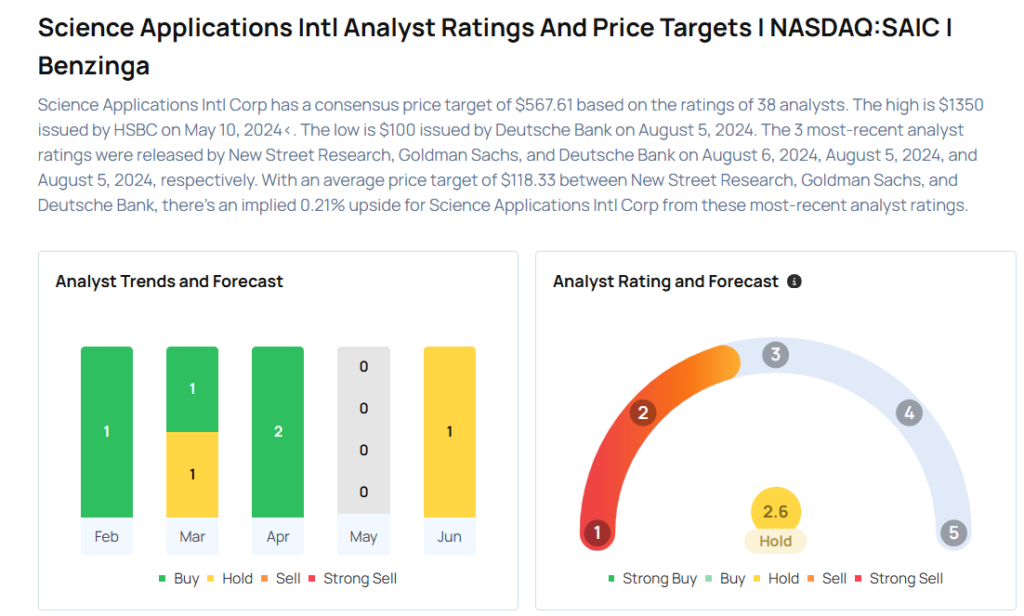

These analysts made changes to their price targets on SAIC following earnings announcement.

- UBS analyst Gavin Parsons maintained Science Applications Intl with a Neutral and lowered the price target from $121 to $111.

- Truist Securities analyst Tobey Sommer maintained SAIC with a Hold and cut the price target from $115 to $100.

Considering buying SAIC stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From Hewlett Packard Enterprise Stock Ahead Of Q2 Earnings

Photo via Shutterstock