Guidewire Software, Inc. (NYSE:GWRE) will release its third-quarter earnings results after the closing bell on Tuesday, June 3.

Analysts expect the San Mateo, California-based company to report quarterly earnings at 47 cents per share, up from 26 cents per share in the year-ago period. Guidewire Software projects to report quarterly revenue at $286.39 million, compared to $240.68 million a year earlier, according to data from Benzinga Pro.

On May 11, Guidewire and Mitsui Direct announced a strategic cloud migration to drive claims innovation and digital growth.

Guidewire Software shares rose 0.1% to close at $215.24 on Monday.

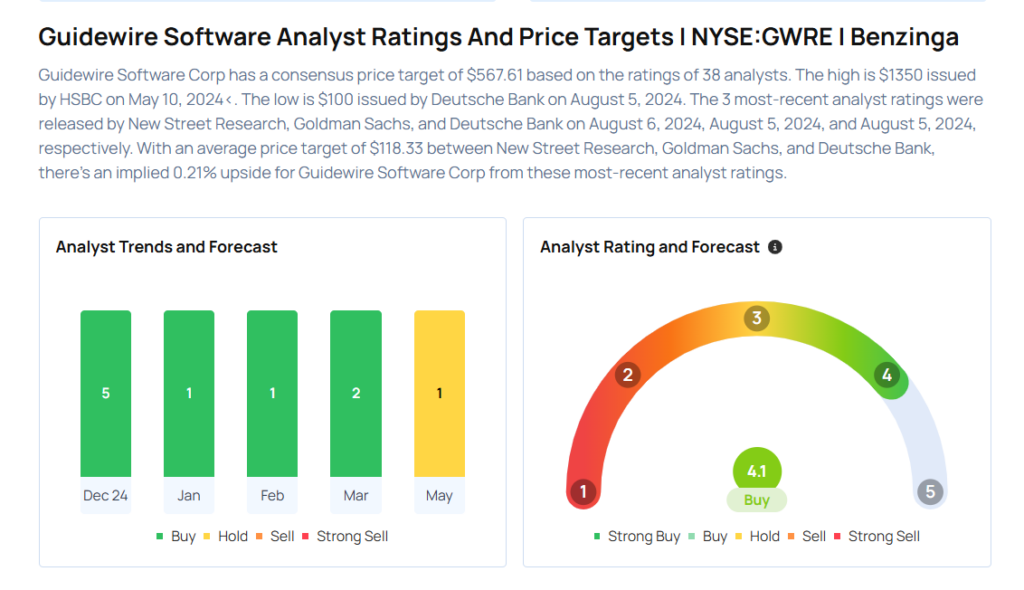

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- DA Davidson analyst Peter Heckmann downgraded the stock from Buy to Neutral with a price target of $226 on May 22, 2025. This analyst has an accuracy rate of 76%.

- JP Morgan analyst Alexei Gogolev maintained an Overweight rating and raised the price target from $228 to $231 on March 7, 2025. This analyst has an accuracy rate of 70%.

- Baird analyst Joe Vruwink maintained an Outperform rating and increased the price target from $230 to $236 on March 7, 2025. This analyst has an accuracy rate of 75%.

- Needham analyst Mayank Tandon reiterated a Hold rating on March 7, 2025. This analyst has an accuracy rate of 68%.

- Goldman Sachs analyst Adam Hotchkiss maintained a Buy rating and boosted the price target from $210 to $240 on Feb. 10, 2025. This analyst has an accuracy rate of 65%.

Considering buying GWRE stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Tech And Telecom Stocks Delivering High-Dividend Yields

Photo via Shutterstock