Best Buy Co Inc (NYSE:BBY) posted downbeat results for the first quarter.

The company’s first-quarter sales fell around 1% (comparable sales fell 0.7%) year over year to $8.77 billion. It missed the analyst consensus estimate of $9.22 billion. Best Buy reported adjusted earnings of $1.15, missing the consensus of $1.31.

Best Buy lowered its fiscal 2026 adjusted earnings from $6.20-$6.60 per share to $6.15-$6.30 per share versus consensus of $6.13 per share. The company lowered its sales guidance from $41.4 billion to $42.2 billion to $41.1 billion to $41.9 billion. The consensus hovers around $41.44 billion.

Best Buy shares fell 0.5% to trade at $65.98 on Friday.

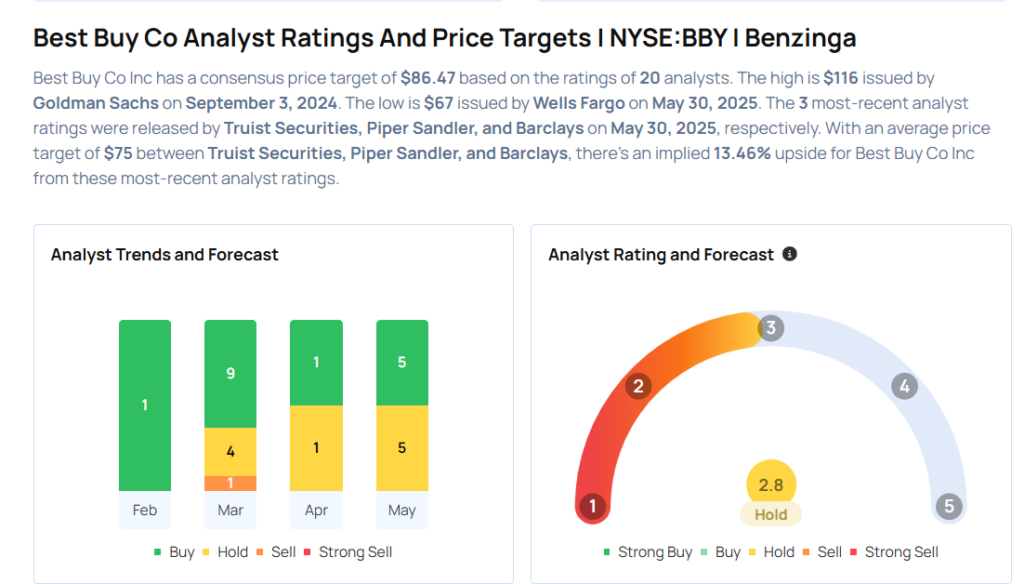

These analysts made changes to their price targets on Best Buy following earnings announcement.

- Wells Fargo analyst Zachary Fadem maintained Best Buy with an Equal-Weight rating and lowered the price target from $75 to $67.

- Wedbush analyst Alicia Reese maintained the stock with a Neutral and lowered the price target from $75 to $70.

- UBS analyst Michael Lasser maintained Best Buy with a Buy and lowered the price target from $95 to $90.

- Barclays analyst Seth Sigman maintained the stock with an Equal-Weight rating and lowered the price target from $89 to $74.

- Piper Sandler analyst Peter Keith maintained Best Buy with an Overweight rating and lowered the price target from $92 to $82.

- Truist Securities analyst Scot Ciccarelli maintained the stock with a Hold and raised the price target from $64 to $69.

Considering buying BBY stock? Here’s what analysts think:

Read This Next:

- Top 3 Materials Stocks That Could Blast Off This Month

Photo via Shutterstock