Kohl’s Corporation (NYSE:KSS) will release its first-quarter earnings results before the opening bell on Thursday, May 29.

Analysts expect the Menomonee Falls, Wisconsin-based company to report a quarterly loss at 22 cents per share, versus a year-ago loss of 24 cents per share in the year-ago period. According to data from Benzinga Pro, Kohl’s projects to report quarterly revenue at $3.06 billion, compared to $3.18 billion a year earlier.

On May 15, Kohl’s announced the pricing of private offering of $360 million of senior secured notes.

Kohl’s shares gained 2.4% to close at $8.10 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

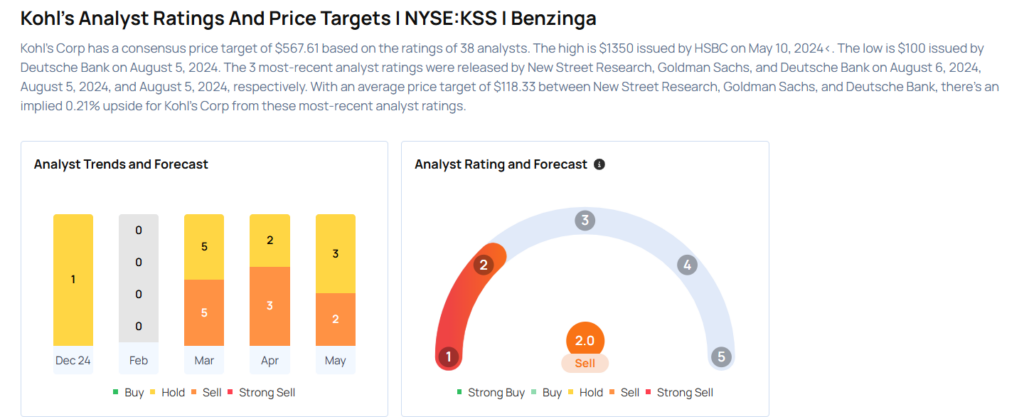

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Telsey Advisory Group analyst Dana Telsey maintained a Market Perform rating with a price target of $9 on May 22, 2025. This analyst has an accuracy rate of 60%.

- JP Morgan analyst Matthew Boss maintained an Underweight rating and boosted the price target from $7to $8 on May 19, 2025. This analyst has an accuracy rate of 67%.

- Goldman Sachs analyst Brooke Roach maintained a Sell rating and raised the price target from $4 to $4.5 on May 2, 2025. This analyst has an accuracy rate of 65%.

- Evercore ISI Group analyst Michael Binetti maintained an In-Line rating and cut the price target from $9 to $8 on May 2, 2025. This analyst has an accuracy rate of 65%.

- Baird analyst Mark Altschwager maintained a Neutral rating and lowered the price target from $9 to $8 on May 2, 2025. This analyst has an accuracy rate of 66%

Considering buying KSS stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says This Quantum Computing Stock Is ‘So High’ And ‘Too Speculative’

Photo via Shutterstock