On Friday, the U.S. Food and Drug Administration (FDA) approved Liquidia Corporation's (NASDAQ:LQDA) Yutrepia (treprostinil) inhalation powder, a prostacyclin analog for adults with pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD) to improve exercise ability.

In August 2024, the FDA issued tentative approval of Yutrepia for the PAH and PH-ILD indications.

Liquidia shares fell 5.2% to trade at $14.80 on Wednesday.

These analysts made changes to their price targets on Liquidia following the announcement.

- Wells Fargo analyst Tiago Fauth maintained Liquidia with an Overweight rating and raised the price target from $20 to $23.

- HC Wainwright & Co. analyst Andrew Fein maintained the stock with a Buy and raised the price target from $29 to $35.

- Needham analyst Serge Belanger, meanwhile, reiterated Liquidia with a Buy and maintained a $25 price target.

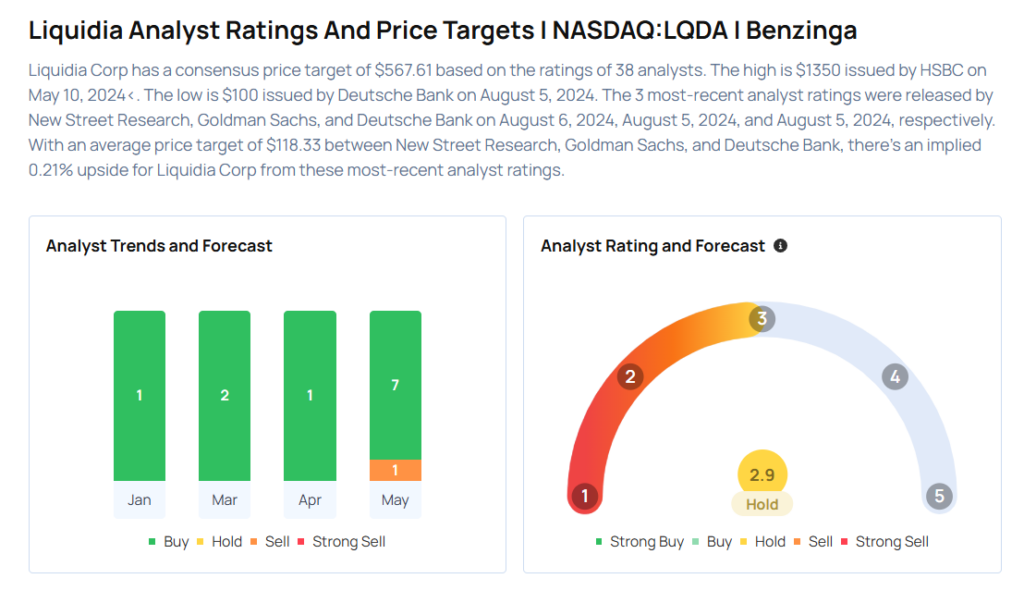

Considering buying LQDA stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From HP Stock Ahead Of Q2 Earnings