PDD Holdings Inc. (NASDAQ:PDD) will release its first-quarter earnings results before the opening bell on Tuesday, May 27.

Analysts expect the Dublin, Ireland-based company to report quarterly earnings at $2.49 per share. According to data from Benzinga Pro, PDD Holdings projects to report quarterly revenue at $14.17 billion.

On March 21, PDD Holdings reported fourth-quarter earnings that missed revenue expectations.

PDD Holdings shares fell 0.5% to close at $119.24 on Friday.

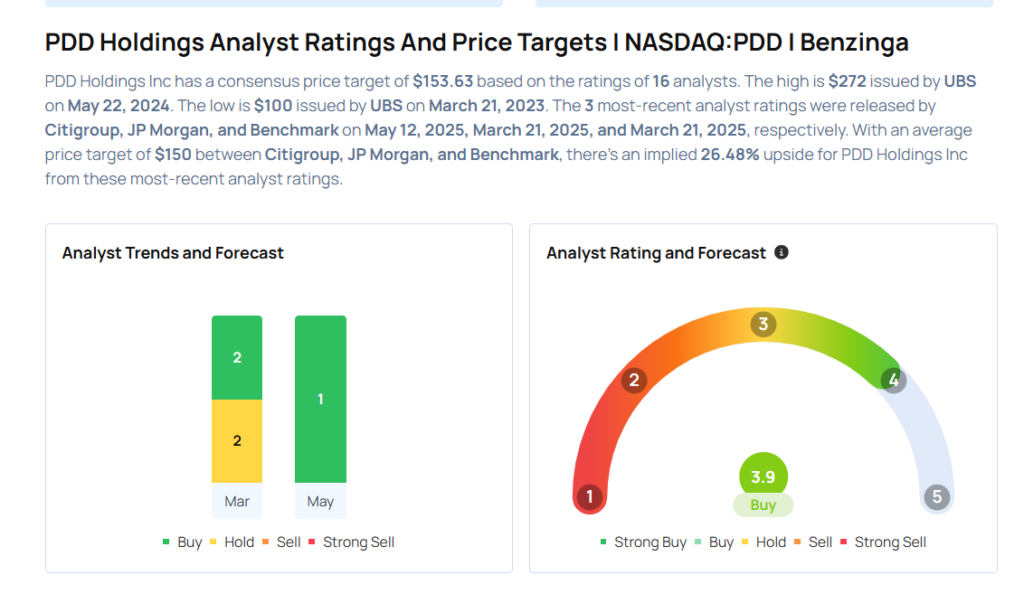

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Benchmark analyst Fawne Jiang reiterated a Buy rating with a price target of $160 on March 21, 2025. This analyst has an accuracy rate of 69%.

- Nomura analyst Jialong Shi downgraded the stock from Buy to Neutral and slashed the price target from $137 to $130 on March 20, 2025. This analyst has an accuracy rate of 75%.

- Jefferies analyst Thomas Chong maintained a Buy rating and cut the price target from $171 to $156 on March 20, 2025. This analyst has an accuracy rate of 60%.

- Barclays analyst Jiong Shao maintained an Overweight rating and slashed the price target from $224 to $158 on Aug. 27, 2025. This analyst has an accuracy rate of 69%.

Considering buying PDD stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Industrial Stocks Delivering High-Dividend Yields

Photo via Shutterstock