Okta, Inc. (NASDAQ:OKTA) will release its first-quarter earnings results after the closing bell on Tuesday, May 27.

Analysts expect the San Francisco, California-based company to report quarterly earnings at 77 cents per share, up from 65 cents per share in the year-ago period. According to data from Benzinga Pro, Okta projects to report quarterly revenue at $680.08 million, compared to $617 million a year earlier.

On April 28, S&P Dow Jones Indices announced that cybersecurity firm Okta will replace Berry Global Group Inc. in the S&P MidCap 400.

Okta shares fell 0.2% to close at $123.72 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

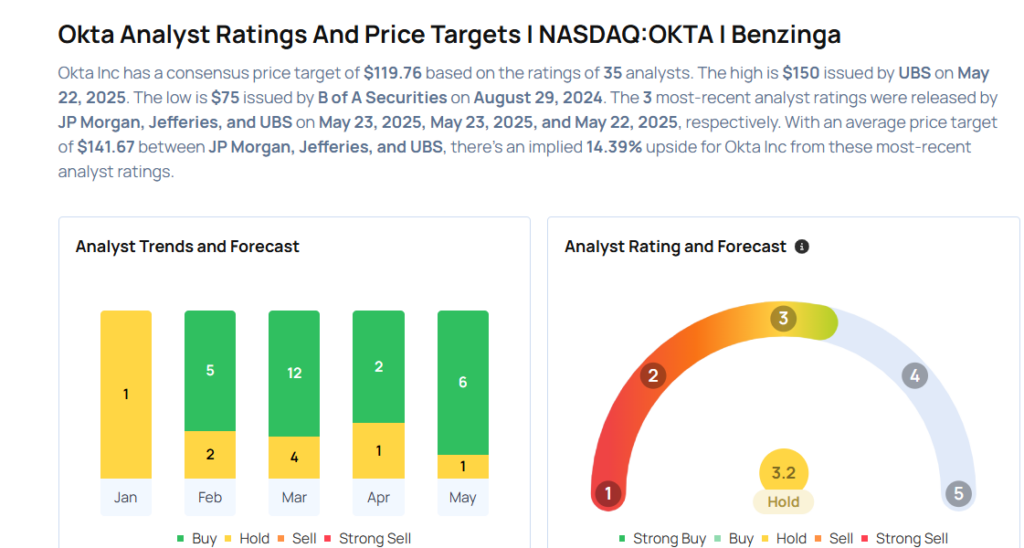

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Brian Essex maintained an Overweight rating and raised the price target from $120 to $140 on May 23, 2025. This analyst has an accuracy rate of 68%.

- Jefferies analyst Joseph Gallo maintained a Hold rating and boosted the price target from $110 to $135 on May 23, 2025. This analyst has an accuracy rate of 74%.

- UBS analyst Roger Boyd maintained a Buy rating and increased the price target from $120 to $150 on May 22, 2025. This analyst has an accuracy rate of 69%.

- Mizuho analyst Gregg Moskowitz maintained an Outperform rating and raised the price target from $127 to $135 on May 15, 2025. This analyst has an accuracy rate of 71%.

- BMO Capital analyst Keith Bachman maintained a Market Perform rating and boosted the price target from $130 to $135 on May 14, 2025. This analyst has an accuracy rate of 82%

Considering buying OKTA stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Industrial Stocks Delivering High-Dividend Yields

Photo via Shutterstock