The TJX Companies, Inc. (NYSE:TJX) will release its first-quarter earnings results before the opening bell on Wednesday, May 22.

Analysts expect the Framingham, Massachusetts-based company to report quarterly earnings at 91 cents per share. That's down from 93 cents per share in the year-ago period. According to data from Benzinga Pro, TJX projects to report quarterly revenue at $13.03 billion, compared to $12.48 billion a year earlier.

On Feb. 26, the company reported that its fourth-quarter FY25 sales remained flat year-on-year to $16.4 billion, beating the analyst consensus estimate of $16.20 billion.

TJX shares fell 0.1% to close at $134.93 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

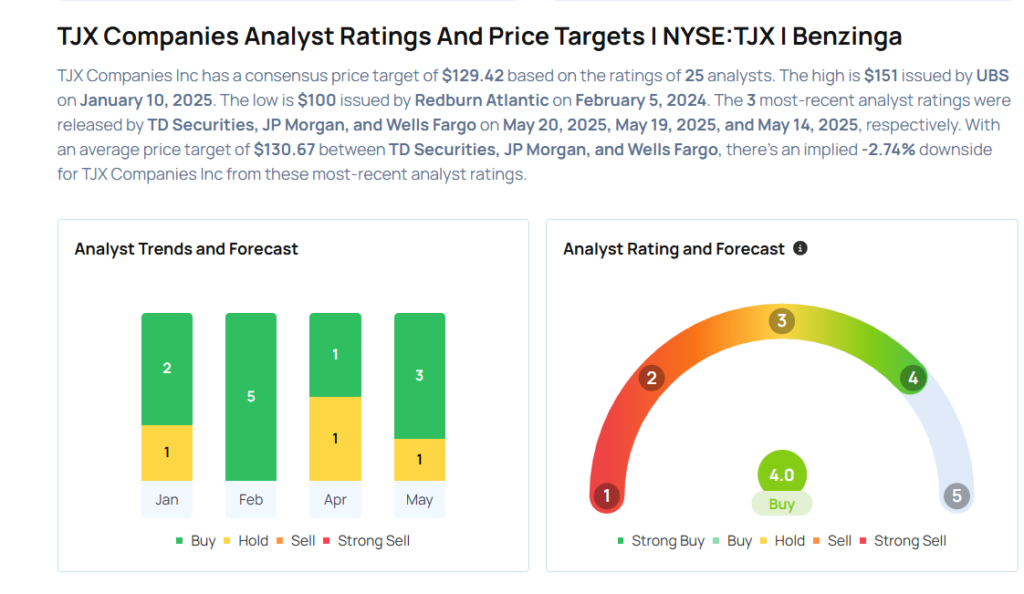

- TD Securities analyst John Kernan maintained a Buy rating and raised the price target from $140 to $142 on May 20, 2025. This analyst has an accuracy rate of 70%.

- JP Morgan analyst Matthew Boss maintained an Overweight rating and raised the price target from $127 to $130 on May 19, 2025. This analyst has an accuracy rate of 68%.

- Wells Fargo analyst Ike Boruchow maintained an Equal-Weight rating and increased the price target from $115 to $120 on May 14, 2025. This analyst has an accuracy rate of 72%.

- Citigroup analyst Paul Lejuez upgraded the stock from Neutral to Buy and raised the price target from $128 to $140 on April 3, 2025. This analyst has an accuracy rate of 65%.

- BMO Capital analyst Simeon Siegel maintained an Outperform rating and increased the price target from $133 to $145 on Feb. 27, 2025. This analyst has an accuracy rate of 75%

Considering buying TJX stock? Here’s what analysts think:

Read This Next:

- Top 2 Risk Off Stocks That Are Ticking Portfolio Bombs

Photo via Shutterstock