Autodesk Inc. (NASDAQ:ADSK) reported better-than-expected first-quarter financial results, issued strong guidance for the second quarter, and raised its FY26 guidance on Thursday.

Autodesk reported quarterly earnings of $2.29 per share, which beat the analyst consensus estimate of $2.15 per share. Quarterly revenue of $1.63 billion beat the Street estimate of $1.61 billion.

"Against an uncertain geopolitical, macroeconomic, and policy backdrop, our strong performance in the first quarter of fiscal '26 set us up well for the year," said Andrew Anagnost, Autodesk CEO.

Autodesk said it expects second-quarter adjusted EPS of between $2.44 and $2.48, versus the $2.34 analyst estimate, and revenue in a range of $1.72 billion to $1.73 billion, versus the $1.7 billion estimate.

The company raised its fiscal 2026 adjusted EPS guidance from a range of $9.34 to $9.67 to a new range of $9.50 to $9.73, versus the $9.52 estimate. Autodesk raised its fiscal revenue guidance from between $6.89 billion and $6.96 billion to between $6.92 billion and $7 billion, versus the $6.93 billion estimate.

Autodesk shares fell 0.5% to $293.49 on Friday.

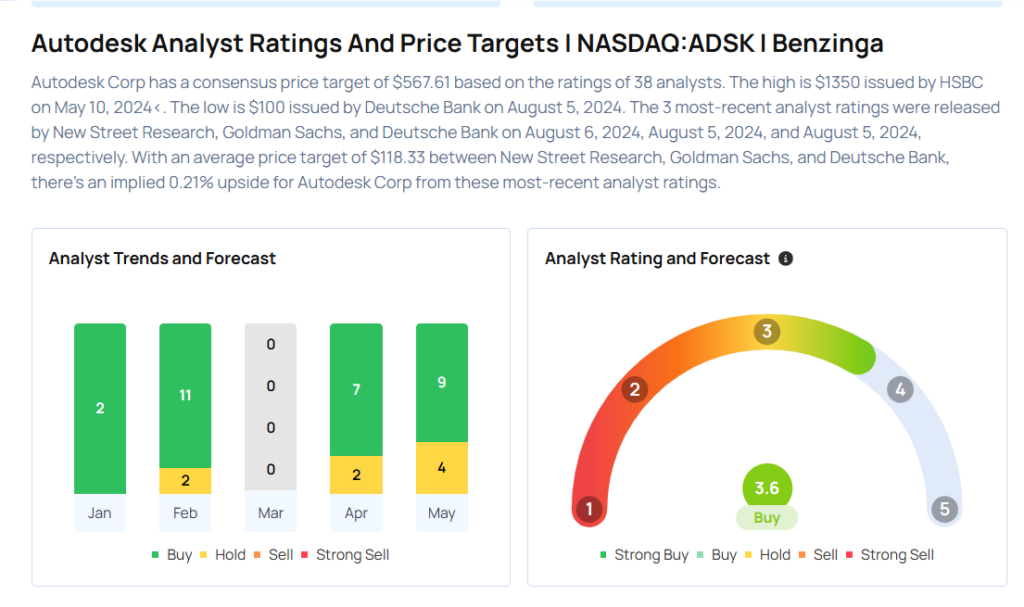

These analysts made changes to their price targets on Autodesk following earnings announcement.

- Rosenblatt analyst Blair Abernethy maintained Autodesk with a Buy and raised the price target from $340 to $345.

- DA Davidson analyst William Jellison maintained the stock with a Neutral and raised the price target from $265 to $305.

- Morgan Stanley analyst Keith Weiss maintained Autodesk with an Overweight rating and raised the price target from $330 to $370.

- Keybanc analyst Jason Celino maintained Autodesk with an Overweight rating and raised the price target from $323 to $350.

- Barclays analyst Saket Kalia maintained Autodesk with an Overweight rating and raised the price target from $325 to $355.

- Stifel analyst Adam Borg maintained Autodesk with a Buy and raised the price target from $310 to $350.

- BMO Capital analyst Daniel Jester maintained the stock with a Market Perform and raised the price target from $324 to $333.

- Goldman Sachs analyst Kash Rangan maintained Autodesk with a Neutral and boosted the price target from $270 to $300.

- B of A Securities analyst Michael Funk maintained the stock with a Neutral and raised the price target from $290 to $330.

Considering buying ADSK stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says Medical Properties Trust Has ‘Too Much Risk,’ Likes This Industrial Stock

Photo via Shutterstock