Home Depot Inc. (NYSE:HD) reported better-than-expected first-quarter sales results and reaffirmed its full-year outlook on Tuesday.

Sales rose 9.4% year over year to $39.86 billion, topping the $39.33 billion consensus. Adjusted earnings per share fell 3% to $3.56, missing the $3.60 estimate.

“Our first quarter results were in line with our expectations as we saw continued customer engagement across smaller projects and in our spring events,” commented Ted Decker, chair, president, and CEO.

Home Depot reaffirmed it forecast of total sales growth of 2.8% year-over-year, reaching $163.98 billion, below the consensus of $164.17 billion. The company anticipates adjusted earnings per share will decline about 2% to $14.94, lower than the $14.99 consensus estimate.

Home Depot shares fell 0.7% to trade at $374.33 on Wednesday.

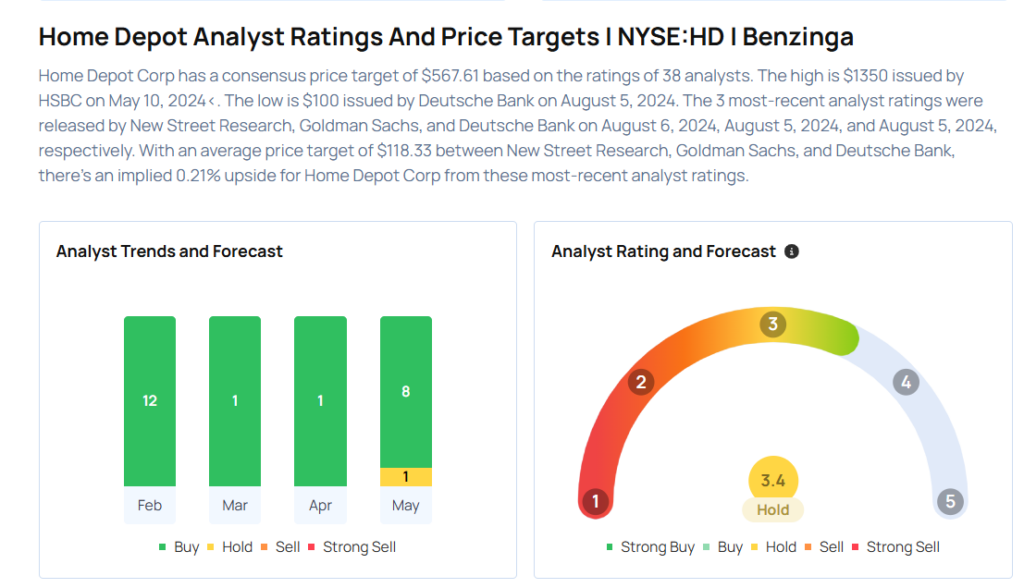

These analysts made changes to their price targets on Home Depot following earnings announcement.

- Bernstein analyst Zhihan Ma maintained Home Depot with a Market Perform and raised the price target from $380 to $398.

- Baird analyst Peter Benedict maintained the stock with an Outperform rating and lowered the price target from $430 to $425.

- Guggenheim analyst Steven Forbes reiterated Home Depot with a Buy and maintained a $450 price target.

- TD Securities analyst Max Rakhlenko reiterated the stock with a Buy and maintained a $470 price target.

Considering buying HD stock? Here’s what analysts think:

Read This Next:

- Target, Lowe’s And 3 Stocks To Watch Heading Into Wednesday