Walmart Inc. (NYSE:WMT) reported better-than-expected earnings for its first quarter on Thursday.

The company posted first-quarter FY26 sales growth of 2.5% year-on-year (Y/Y) to $165.60 billion, marginally missing the analyst consensus estimate of $165.88 billion. The retailer reported adjusted EPS of 61 cents, beating the consensus estimate of 58 cents.

“We delivered a solid first quarter in a dynamic operating environment. We’re serving customers and members in more ways, which is fueling our growth. We’re well positioned, maintaining flexibility to navigate the near-term while continuing to invest to create value for the long-term.” said President and CEO Doug McMillon.

For fiscal year 2026, Walmart reaffirmed an adjusted EPS outlook of $2.50 – $2.60, vs. the $2.61 estimate and sales guidance of $694.70 billion—$701.50 billion vs. the street view of $705.30 billion.

Walmart shares gained 1.6% to trade at $97.85 on Friday.

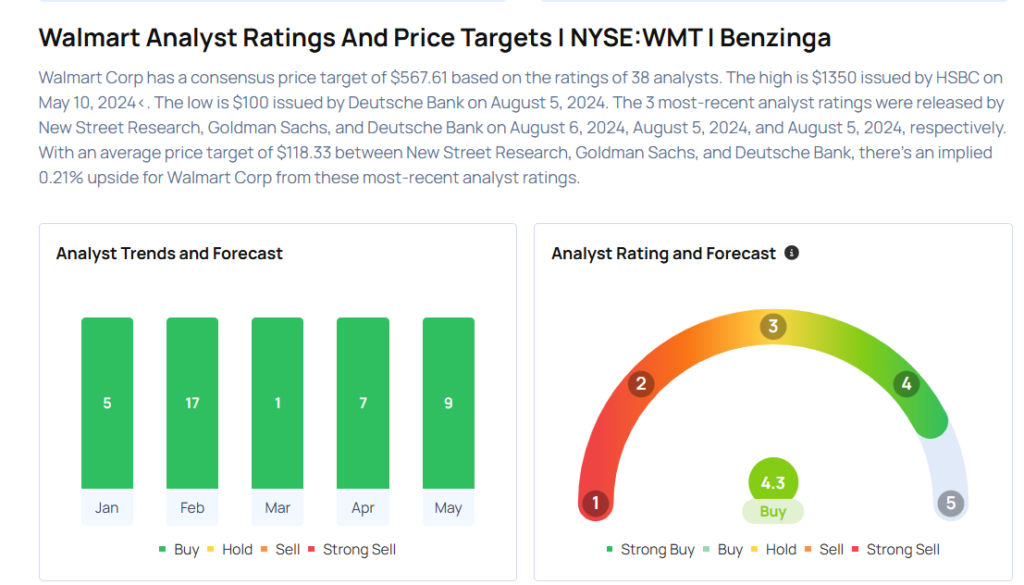

These analysts made changes to their price targets on Walmart following earnings announcement.

- Baird analyst Peter Benedict maintained Walmart with an Outperform rating and raised the price target from $100 to $110.

- Truist Securities analyst Scot Ciccarelli maintained the stock with a Buy and raised the price target from $107 to $111.

- RBC Capital analyst Steven Shemesh reiterated Walmart with an Outperform rating and maintained a $102 price target.

- Telsey Advisory Group analyst Joseph Feldman maintained the stock with an Outperform rating and maintained a $115 price target.

- DA Davidson analyst Michael Baker maintained Walmart with a Buy and maintained a $117 price target

Considering buying WMT stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Prefers AutoZone Over Rival: ‘Buy The One That’s Not Going To Stock Split’

Photo via Shutterstock