Doximity, Inc. (NYSE:DOCS) reported better-than-expected earnings for the fourth quarter on Thursday.

The company posted quarterly earnings of 38 cents per share which beat the analyst consensus estimate of 27 cents per share. The company reported quarterly sales of $138.29 million which beat the analyst consensus estimate of $133.73 million.

"We closed out fiscal 2025 on a high note, with record engagement, strong profits, and 20% annual revenue growth," said Jeff Tangney, co-founder and CEO of Doximity. "Our newsfeed, workflow and AI tools all hit fresh highs in the fourth quarter, helping doctors save time and provide the best care for their patients."

Doximity guided for fiscal first-quarter revenue of $139 million to $140 million versus estimates of $143.34 million, according to Benzinga Pro. The company also forecasted full-year 2026 revenue of $619 million to $631 million versus estimates of $634.6 million.

Doximity shares fell 9.8% to trade at $52.72 on Friday.

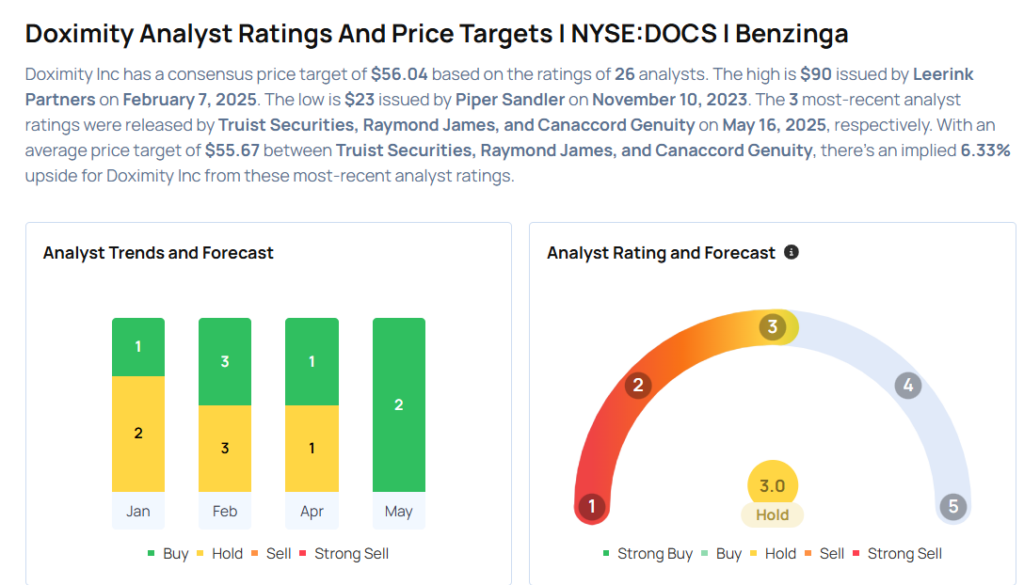

These analysts made changes to their price targets on Doximity following earnings announcement.

- Needham analyst Scott Berg maintained Doximity with a Buy and lowered the price target from $82 to $67.

- Canaccord Genuity analyst Richard Close maintained the stock with a Hold and lowered the price target from $71 to $50.

- Raymond James analyst Brian Peterson maintained Doximity with an Outperform rating and lowered the price target from $83 to $65.

- Truist Securities analyst Jailendra Singh maintained the stock with a Hold and slashed the price target from $58 to $52.

Considering buying DOCS stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Prefers AutoZone Over Rival: ‘Buy The One That’s Not Going To Stock Split’

Photo via Shutterstock