Networking and communications giant Cisco Systems Inc. (NASDAQ:CSCO) is laying the groundwork to upend a core pillar of enterprise cybersecurity, that is, the humble firewall.

What Happened: During its third quarter earnings call on Wednesday, the company signaled a radical shift in the architecture of its products by embedding security directly into the network infrastructure.

Cisco's new HyperShield system, together with its latest smart network switch, shows the company is moving away from selling traditional firewall boxes. Instead, it's starting to build security features directly into the network itself, so threats can be blocked as data flows through, without needing any additional hardware.

See Also: Warren Buffett Explains Why He Couldn’t Deny Greg Abel The Top Job At Berkshire Hathaway Any Longer: ‘He’s A Natural’

“The majority of our new HyperShield enterprise customers are bundling it with our new N9300 smart switch because of our unique ability to embed security directly into the fabric of the network,” said CEO Chuck Robbins.

Robbins cites a conversation with a Fortune 100 CISO (Chief Information Security Officer) for this move, who reportedly said, “If you can't define an architecture that has me removing every physical firewall from my infrastructure, then I don't want to talk to you,” while speaking with Cisco’s senior leadership.

Why It Matters: The removal of separate, physical firewall devices altogether has major implications for the cybersecurity industry, especially for legacy firewall vendors, a segment that is worth $22.87 billion in 2025, according to a report by Mordor Intelligence.

The company released its third quarter results on Wednesday, reporting $14.15 billion in revenue, beating street estimates at $14.08 billion, with a profit of $0.96 per share, against consensus figures at $0.92.

Price Action: Cisco shares were down 0.79% on Wednesday, trading at $61.29, but are up 3.03% after hours, following the company’s earnings release.

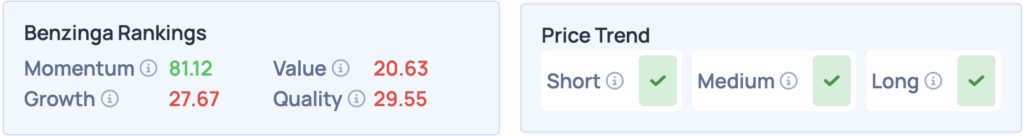

The stock scores 81.12th percentile on momentum, but falls short on growth, value, and quality according to Benzinga’s Edge Stock Rankings. It also features a favorable price trend in the short, medium, and long term. Let’s see how it compares with peers.

Read More:

- Jim Cramer Says Even ‘Safety’ Stocks Look Risky, Warns Of ‘Wild Card’ In Washington And Rising Treasury Yields As Reasons To Stay Away From Sure Bets