Biodesix, Inc. (NASDAQ:BDSX) reported weaker-than-expected results for the first quarter on Tuesday.

The company posted quarterly losses of 8 cents per share which missed the analyst consensus estimate of losses of 7 cents per share. The company reported quarterly sales of $17.96 million which missed the analyst consensus estimate of $19.47 million.

“Our quarter was highlighted by continued progress toward our three key goals for 2025 – growing top line revenue, improving operational efficiencies and leverage, and advancing our pipeline,” said Scott Hutton, Chief Executive Officer. “Year-over-year, we grew revenue by 21%, powered by growth in both our lung diagnostic testing and diagnostic services, all while decreasing our SG&A spend. Lung Diagnostics revenue grew 18%, which is the 16th straight quarter of greater than 15% growth. We also increased our already strong gross margins to 79.4%, improved Net Loss by 18% and Adjusted EBITDA by 11% on our path to profitability, and presented multiple studies on our pipeline products to help facilitate future growth.”

Biodesix lowered its FY2025 sales guidance from $92.00 million-$95.00 million to $80.00 million-$85.00 million.

Biodesix shares fell 39.3% to trade at $0.2180 on Wednesday.

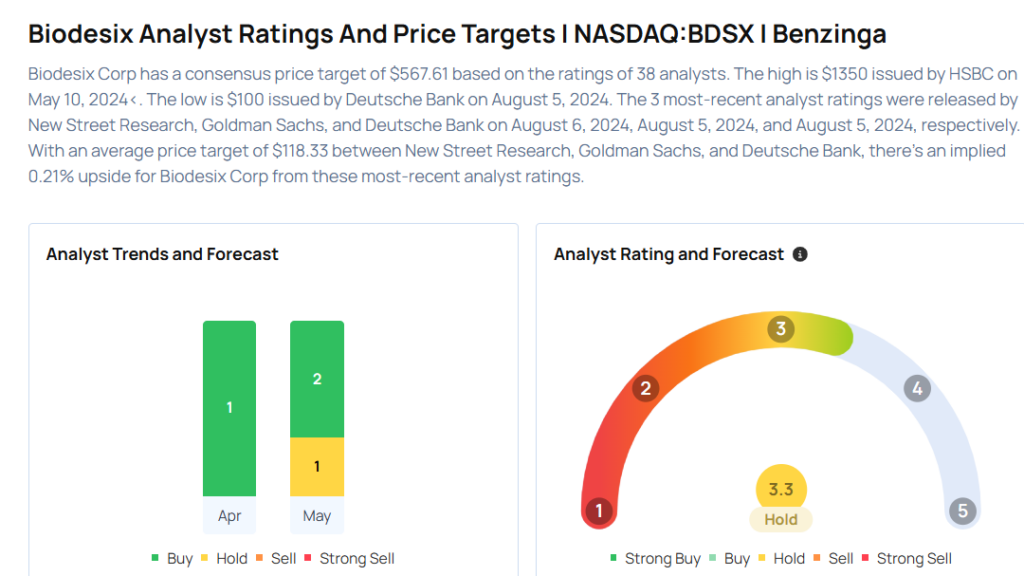

These analysts made changes to their price targets on Biodesix following earnings announcement.

- Lake Street analyst Thomas Flaten maintained Biodesix with a Buy and lowered the price target from $3 to $2.

- Canaccord Genuity analyst Kyle Mikson maintained the stock with a Buy and lowered the price target from $2.5 to $1.5.

- William Blair analyst Brian Weinstein downgraded Biodesix from Outperform to Market Perform.

Considering buying BDSX stock? Here’s what analysts think:

Read This Next:

- Coinbase To Rally Around 17%? Here Are 10 Top Analyst Forecasts For Wednesday

Photo via Shutterstock