Dating app giant Tinder, Hinge, and Match.com’s parent company, Match Group Inc. (NASDAQ:MTCH), missed estimates but announced restructuring plans spearheaded by new CEO Spencer Rascoff during its first quarter earnings call.

What Happened: Rascoff unveiled a strategy focused on unifying the company’s diverse portfolio of brands, integrating artificial intelligence across its platforms, and prioritizing product innovation to spur growth.

However, layoffs were also the primary part of the company’s plan.

“We’ve also taken some hard, but appropriate steps today to sharpen our focus, including a planned 13% reduction of our workforce, as well as closing a number of open roles and further tightening operating expenses,” he said.

He explained that the deep integration of artificial intelligence with Tinder aimed at attracting a younger, Gen Z audience. These include “Double Date,” allowing users to pair up with friends, and “The Game Game,” a voice-based experience using AI for flirting practice.

Rascoff highlighted that Hinge continues to be a strong performer in the “intentioned dating” category.

The app saw a 23% year-over-year increase in direct revenue, driven by user growth and the successful launch of an AI-powered recommendation algorithm that has boosted matches and contact exchanges.

See Also: Warren Buffett Falls Behind Nancy Pelosi In Stock Market Returns Over The Last 11 Years: Here’s What Data Shows

Why It Matters: While the company’s total revenue of $831.2 million slightly surpassed the analyst consensus estimate of $827.5 million, representing a 3% year-over-year decline, its GAAP earnings per share of $0.44 missed the expected $0.45.

The number of paying users also fell by 5% to 14.2 million compared to the same period last year.

Looking ahead, Match Group reaffirmed its full-year 2025 total revenue guidance but noted potential headwinds from macroeconomic conditions and foreign exchange rate volatility.

MTCH shares were lower by 15.76% on a year-to-date basis and 10.17% over a year. On Thursday, the shares closed 9.58% lower.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Thursday. The SPY ended 0.70% higher at $565.06, while the QQQ advanced 1.03% to $488.29, according to Benzinga Pro data.

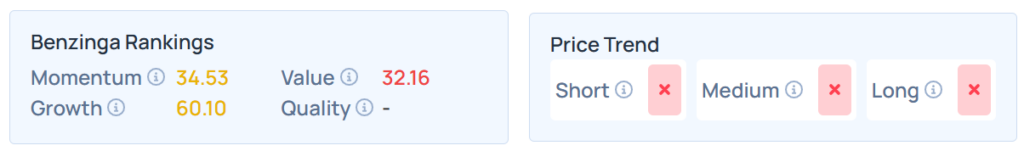

Benzinga Edge Stock Rankings shows that MTCH had a weaker price trend over the short, medium, and long term. Its momentum ranking was weak at 34.53th percentile, whereas its value ranking was poor at 32.16th percentile; the details of other metrics are available here.

Read Next:

- China Could Sell Its US Holdings Without Having To ‘Give In,’ Says Expert: ‘Risk Asset Prices Are Trump’s Achilles Heel’

Photo by Koshiro K via Shutterstock