EverCommerce Inc. (NASDAQ:EVCM) reported better-than-expected first-quarter sales results, after the closing bell on Thursday.

EverCommerce reported quarterly earnings of 1 cent per share which missed the analyst consensus estimate of 3 cents per share. The company reported quarterly sales of $142.27 million which beat the analyst consensus estimate of $139.57 million.

“EverCommerce’s first quarter results exceeded the top end of our guidance range for both Revenue and Adjusted EBITDA, driven by strong execution and continued active cost management,” said Eric Remer, EverCommerce’s Founder and CEO. “We continue to make solid progress with implementing our transformation and optimization initiatives, which include strategic investments in high margin areas of business such as payments monetization as well as artificial intelligence.”

EverCommerce said it sees second-quarter sales of $144.500 million to $147.500 million, versus market estimates of $145.93 million.

EverCommerce shares gained 2.4% to trade at $11.26 on Monday.

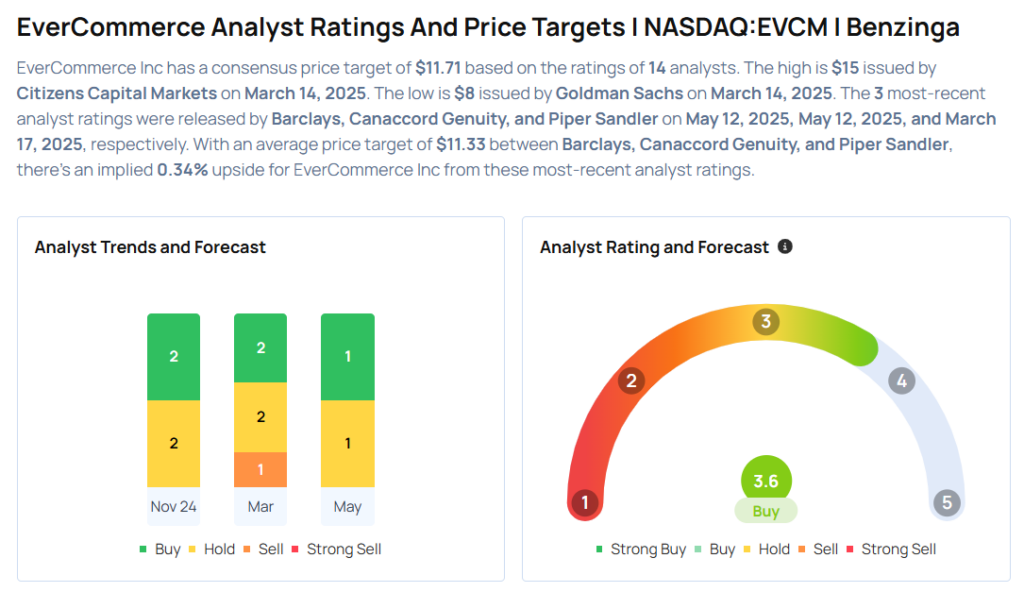

These analysts made changes to their price targets on EverCommerce following earnings announcement.

- Canaccord Genuity analyst David Hynes maintained EverCommerce with a Buy and raised the price target from $13 to $14.

- Barclays analyst Ryan Macwilliams maintained the stock with an Equal-Weight rating and raised the price target from $9 to $11.

Considering buying EVCM stock? Here’s what analysts think:

Read This Next:

- Marriott International To Rally More Than 17%? Here Are 10 Top Analyst Forecasts For Monday

Photo via Shutterstock