Simon Property Group, Inc. (NYSE:SPG) will release earnings results for the first quarter, after the closing bell on Monday, May 12.

Analysts expect the company to report quarterly earnings at $1.36 per share, up from 84 cents per share in the year-ago period. Simon Property projects to report quarterly revenue at $1.34 billion, compared to $1.44 billion a year earlier, according to data from Benzinga Pro.

On March 20, Simon Property Group announced the retirement of its Independent Director Allan B. Hubbard.

Simon Property shares gained 0.1% to close at $163.19 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

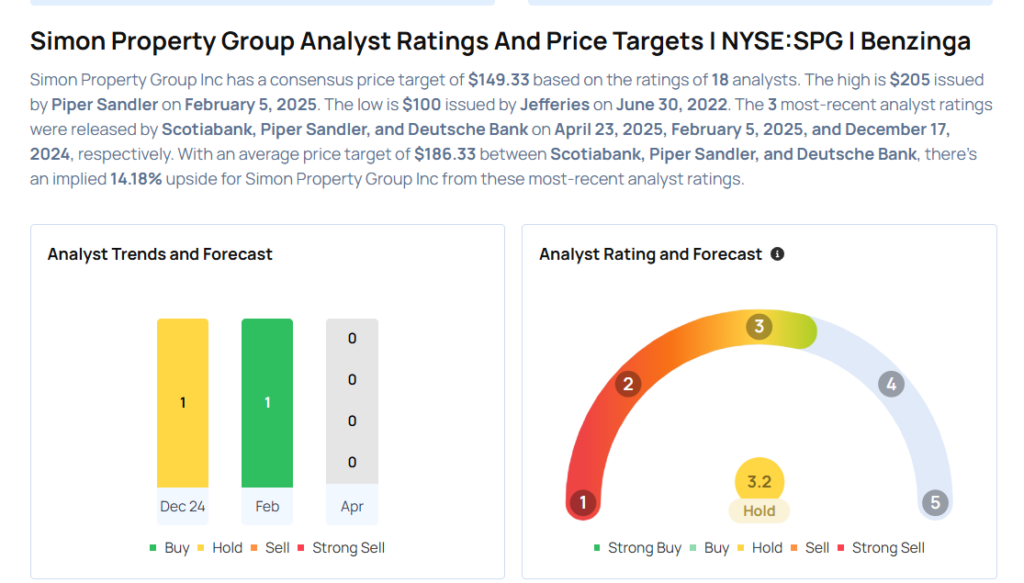

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Deutsche Bank analyst Omotayo Okusanya initiated coverage on the stock with a Hold rating and a price target of $195 on Dec. 17, 2024. This analyst has an accuracy rate of 64%.

- Evercore ISI Group analyst Steve Sakwa upgraded the stock from In-Line to Outperform and boosted the price target from $160 to $172 on Sept. 16, 2024. This analyst has an accuracy rate of 61%.

- Stifel analyst Simon Yarmak downgraded the stock from Buy to Hold and raised the price target from $157.5 to $159 on Sept. 12, 2024. This analyst has an accuracy rate of 61%.

- Truist Securities analyst Ki Bin Kim maintained a Hold rating and raised the price target from $147 to $158 on Aug. 28, 2024. This analyst has an accuracy rate of 68%.

- Argus Research analyst Jacob Kilstein maintained a Buy rating and raised the price target from $157 to $168 on June 11, 2024. This analyst has an accuracy rate of 63%.

Considering buying SPG stock? Here’s what analysts think:

Read This Next:

- Top 3 Industrials Stocks That May Collapse In May

Photo via Shutterstock