International Flavors & Fragrances Inc. (NYSE:IFF) reported better-than-expected earnings for the first quarter, after the closing bell on Tuesday.

The company posted quarterly earnings of $1.20 per share which beat the analyst consensus estimate of $1.14 per share. The company reported quarterly sales of $2.84 billion which beat the analyst consensus estimate of $2.83 billion.

“IFF delivered solid first quarter results, driven by disciplined execution and broad-based growth across most of our business,” said IFF CEO Erik Fyrwald. “Our growth, combined with ongoing productivity initiatives, contributed to a meaningful increase in profitability. We also successfully completed the divestiture of our Pharma Solutions business two months ahead of schedule, a key milestone that supports the achievement of our targeted debt leverage ratio.”

Intl Flavors & Fragrances affirmed FY2025 sales guidance of $10.60 billion to $10.90 billion, versus market estimates of $10.87 billion.

Intl Flavors & Fragrances shares dipped 7.1% to close at $73.59 on Wednesday.

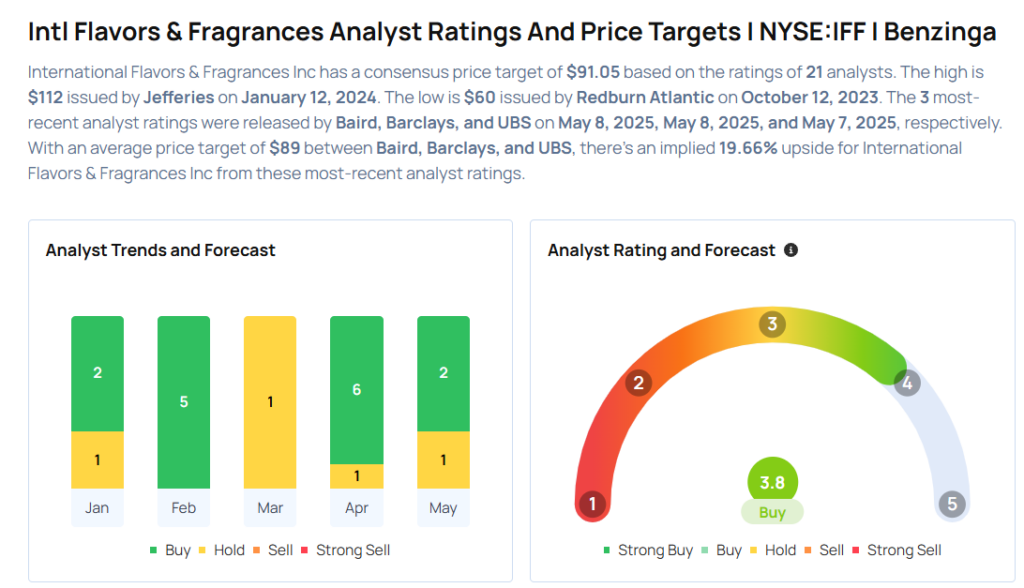

These analysts made changes to their price targets on Intl Flavors & Fragrances following earnings announcement.

- Barclays analyst Lauren Lieberman upgraded Intl Flavors & Fragrances from Equal-Weight to Overweight and raised the price target from $76 to $84.

- Baird analyst Ghansham Panjabi maintained the stock with an Outperform rating and lowered the price target from $110 to $100..

Considering buying IFF stock? Here’s what analysts think:

Read This Next:

- Top 3 Financial Stocks That May Plunge In May

Photo via Shutterstock