Reynolds Consumer Products Inc. (NASDAQ:REYN) reported in-line earnings for the first quarter on Wednesday.

The company posted quarterly earnings of 23 cents per share which met the analyst consensus estimate. The company reported quarterly sales of $818.00 million which missed the analyst consensus estimate of $820.39 million.

“We are executing well in a dynamic consumer and retail environment, outperforming our categories by two points in the quarter,” said Scott Huckins, President and Chief Executive Officer. “Our US-centric manufacturing platform and business model are resilient, and we are effectively navigating the near-term macro challenges in partnership with our retail customers. We are also making progress advancing initiatives to drive growth and margin expansion that deliver long term value.”

The company lowered its FY2025 adjusted earnings guidance from $1.61-$1.68 to $1.54-$1.61.

Reynolds Consumer Products shares fell 1% to trade at $22.78 on Thursday.

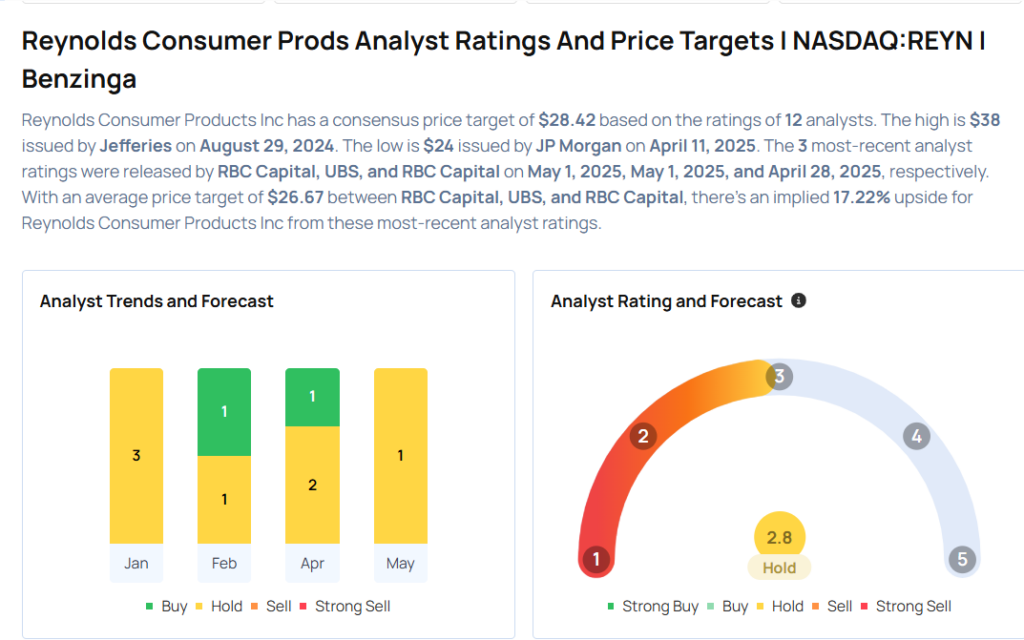

These analysts made changes to their price targets on Reynolds Consumer Products following earnings announcement.

- UBS analyst Peter Grom maintained Reynolds Consumer Prods with a Neutral and lowered the price target from $26 to $25.

- RBC Capital analyst Nik Modi maintained the stock with a Sector Perform and lowered the price target from $30 to $25..

Considering buying REYN stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From Apple Stock Ahead Of Q2 Earnings

Photo via Shutterstock